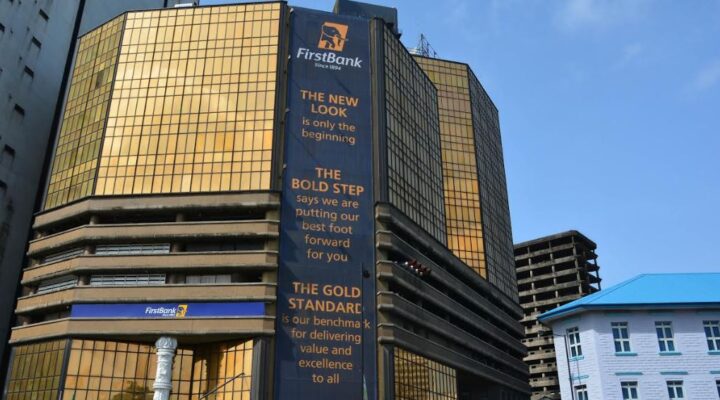

S&P Global Ratings, an American credit rating agency, says changes on the boards of First Bank of Nigeria Limited (FBN) and FBN Holdings Plc (FBNH) addressed corporate governance challenges.

The Central Bank of Nigeria (CBN) recently replaced the entire boards of FBN and FBNH, and reinstated the former executive directors , as well as Adesola Adeduntan, the chief executive officer of the bank.

The apex bank had also requested that FBN unwind certain exposures and divest from its participation in a non-permissible company, also pointing to potential corporate governance lapses at the bank.

In a statement, the rating agency said the board changes also helped to ensure the financial stability of Nigeria’s banking sector.

Advertisement

Although, it noted that its ratings on First Bank and other Nigerian banks remain constrained by shortcomings in corporate governance and transparency, among other factors.

“However, Dr. Adeduntan’s reinstatement and the re-appointment of the other executive directors underscores the CBN’s confidence in the existing management team to continue the turnaround of the third-largest banking group in Nigeria, which has total assets of Nigerian N7.7 trillion,” the statement read.

“We are of the view that the CBN’s historical approach has been more reactive than proactive, as illustrated by the Skye Bank episode. That said, recent actions, while disruptive in the near-term, may signal a more direct and possibly decisive supervisory approach to alleged failings in the management and governance of regulated institutions.”

Advertisement

It said that First Bank’s overall credit profile has gradually stabilised since 2016, with a capital adequacy ratio of 17 percent in 2020, as against a 15 percent minimum requirement.

Similarly, the bank’s asset quality indicators improved significantly, with non-performing loans (NPLs) reducing to 7.7 percent in 2020, from 20-25 percent since 2016.

Fitch, an international credit rating agency, recently affirmed FBNH and FBN at “B-” with a negative outlook. Noting that the recent action of CBN will not have a material effect on the group’s asset quality, profitability and capitalisation.

Advertisement

Add a comment