The Sterling was left vulnerable to losses during trading this week following the dismal UK construction PMI for June which rekindled concerns over a possible slowdown in domestic economic momentum.

This disappointing data comes at a time when the ongoing Brexit uncertainty and global instabilities have exposed the UK economy to downside risks. Concerns are elevated over a possible Brexit fueled recession and with expectations mounting of a probable UK interest rate cut, pound weakness could be the recurrent theme in the global currency markets.

It should be kept in mind that the persistent post-Brexit uncertainty has haunted investor attraction towards the Sterling consequently sabotaging any real recovery in value.

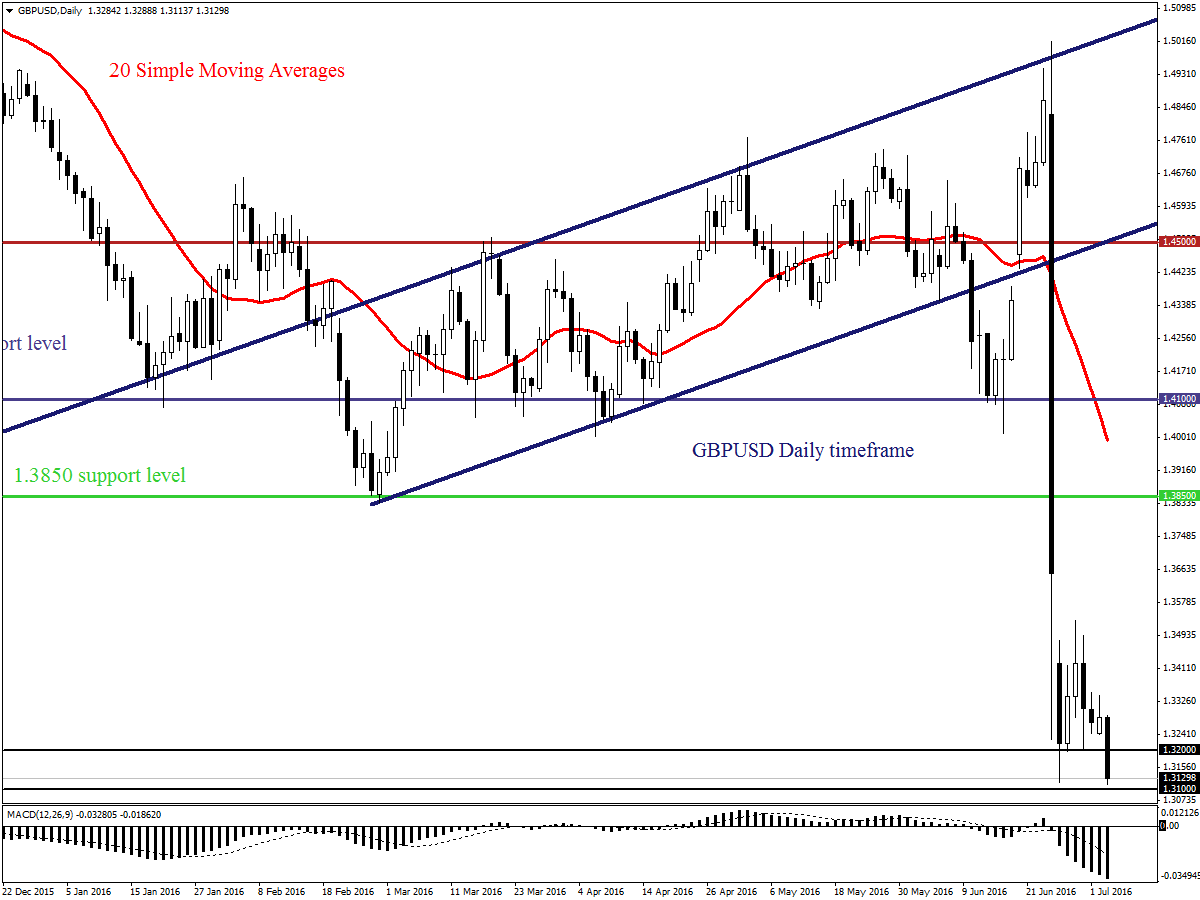

Investors may direct their attention towards the BoE financial stability report which could provide the much needed clarity on how the UK economy may fare post Brexit. With Carney potentially repeating his dovish chorus regarding the future of the UK economy, bears have been provided with yet another opportunity to install a heavy round of selling. From a technical standpoint, the GBPUSD is bearish and the solid breakdown below 1.3200 may have open a path towards 1.3100 and potentially lower.

Advertisement

Stock markets pressured amid Brexit jitters

Global stocks displayed signs of exhaustion during trading on Tuesday as the terrible combination of lingering Brexit blues and ongoing concerns over the global economy haunted investor attraction towards riskier assets. Asian markets concluded depressed on Tuesday with the Yen’s resurgence from risk aversion dragging the Nikkei -0.67% lower.

Advertisement

European equities were at the mercy of the post Brexit blues and could be poised for further declines as fears of prolonged periods of low interest rates punish financial stocks. The bearish contagion from Europe and Asia could infect Wall Street today, consequently sending American stocks lower as investors scatter from riskier assets.

The deceleration in momentum should be of no surprise as questions were already raised on the sustainability of the post-Brexit relief rally. Concerns over the global economy remain elevated while the visible central bank caution may continue to sour investor risk appetite. With the Brexit uncertainty adding to the horrible cocktail of ingredients that have weighed on global sentiment, stock markets could be set for further declines.

Gold buoyed by risk aversion

Gold has enjoyed an extended rally this week with prices edging closer towards the two year high at $1358.20, as a combination of Dollar weakness and post-Brexit jitters attracted investors to safe-haven assets. This precious metal remains firmly bullish and the risk aversion bred from the ongoing concerns over the global economy has successfully kept prices buoyed.

Advertisement

With expectations fading over the Fed raising US rates in 2016, Gold bulls could be unchained consequently providing another reason for the metal to trade higher. Investors will direct their focus towards Friday’s NFP and if this fails to meet expectations, then Gold prices could lurch towards $1360 and potentially higher.

From a technical standpoint, prices are trading above the daily 20 SMA while the MACD has crossed to the upside. Another breakout above $1350 could open a path towards $1385 and potentially higher.

Lukman Otunuga is a research analyst at FXTM.

Advertisement

Add a comment