A few minutes before 4pm, the women commenced their weekly trek to an open space inside the compound of a one-storey building in Iwo Road in Ibadan, Oyo state capital. Those who arrived earlier had arranged the benches. They exchanged pleasantries. In hushed tones, they talked about how their businesses had fared that day, the country’s economic situation, and the biting hardship in the land, ending their conversations with collective heavy sighs. As soon as a quorum was formed, the weekly meeting began.

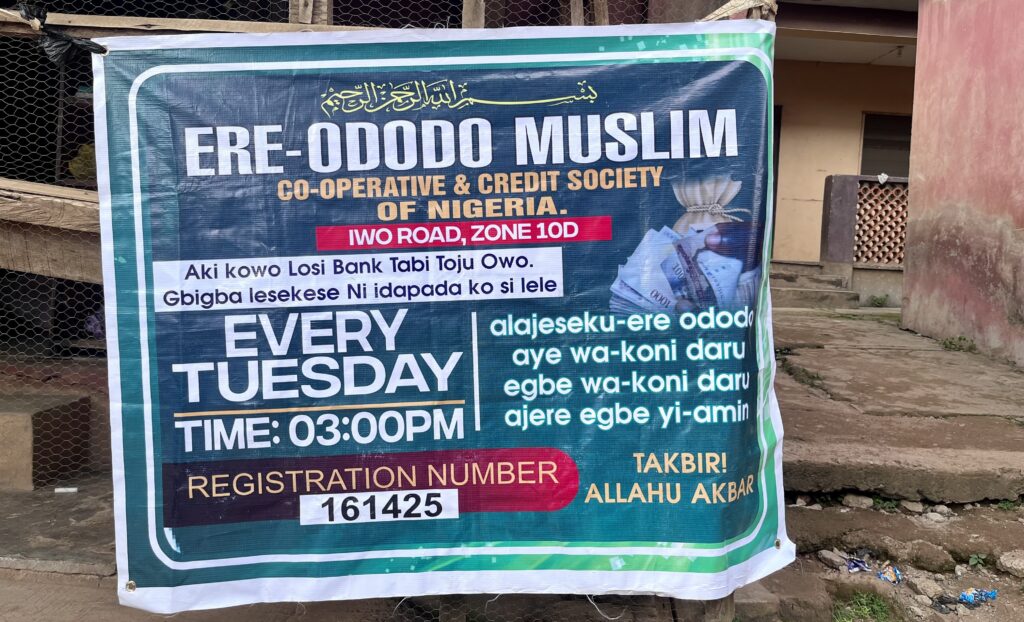

Members of the Ere-Ododo Muslim Cooperative and Credit Society of Nigeria meet every Tuesday at this particular location. The cooperative’s name is unique. Ere-Odo is a Yoruba word that roughly means harvest of honesty. With about 30 members, it was a gathering of traders who sell nylon and plastics, and a few other artisans. Most of them were barely educated market women who had to leave their shops briefly to attend the meeting.

After the opening salutations, they delved straight into business. Everyone dipped their hands into their pockets and purses to bring out money, which they handed over to the secretary, who recorded everything – savings, development fees, and loan repayment. All the money received that day was given to members who needed short and long term loans and other financial help. The association doesn’t hold any money or save in the bank. Everything goes back to members’ businesses.

‘THE ONLY BANK THEY KNOW’

Advertisement

The Muslim cooperative society was founded in 2022 by women traders in the area who came together to start a community-led association that could provide accessible loans to small businesses without collateral and zero interest. Being a Muslim majority group, it is against their faith to lend money with interest. They adopted the halal system – the Islamic finance model that prohibits interest lending. Nevertheless, the association is open to members from other religious groups.

“We don’t discriminate against any religion here. We have Christians and Muslims among us,” Rashidat Abdulganiyu, the group’s secretary, told TheCable. “The main purpose is to help these women boost their businesses and take good care of their homes. They save their money better, get easy access to loans that don’t burden them, and be around a community they trust.

“When these women begin to have some difficulties getting loans because of their educational status or because they do not have the requirements that banks demand, their businesses suffer and they become idle. With that, they cannot contribute to the development of their families. Here, money is always available. It circulates. They don’t have bank accounts. This is the only bank they know.

Advertisement

“When I get the credit, I use the larger part to buy more goods for the shop and the remaining to buy food at home. Then, I return it monthly. On one hand, business is moving forward; on the other hand, the home is not lacking. If you save on your own, some emergencies might pop up, and you’ll dip your hands into it. We often tell members not to use the credits for social parties or to buy clothes.”

New entrants are expected to fill out membership forms, including a lawyer’s and guarantor’s form. After four weeks of membership, they are eligible for basiri, which is a small financial assistance to be paid back bit by bit. This is used to sort out immediate needs like children’s school fees or food. When new members maintain consistent attendance for six months and have enough money saved up, they become eligible for credit, which is to be paid back within 10 months. But before a member can request a loan, the exco will carry out thorough investigations on the person and her business.

To qualify for N1 million naira loan, members must have contributed N500,000 to their savings. Their guarantor from the group must also have N500,000 in their savings. So, if a borrower runs away, their savings and that of the guarantor are used to defray the loan.

More importantly, the borrower also gets a mentor within the group who has a similar business. This, Abdulganiyu said, is to help the new member steer clear of troubled waters. But if you don’t pay back the loan at the right time, you pay a small fine, and you are not entitled to credit for three months.

Advertisement

Aside from the counselling they offer one another during the weekly meetings, the exco also occasionally invites facilitators to address the meeting on business topics that could be helpful to the women.

HELPING UNBANKED WOMEN GET ACCESS TO AFFORDABLE CREDIT

The associations also give the women a sense of belonging and confidence in their trading activities.

“Cooperative makes things better because you save as little as N100 anytime. Then, it builds up into something significant. It’s like a communal system that you can relate to. When I wanted to pay for my daughter’s West African Examinations Council (WAEC) fees and we had no money, I came here, got some money, and we paid. I returned it at the right time,” Mujidat Owolabi, a nylon trader, said.

Advertisement

For Tolu Adeyemi, joining Ere-Ododo was a relief — after an unpleasant experience with digital lenders, commonly called loan sharks, that charge unreasonable interest on credit and send toxic text messages to the borrowers and their family members if payments are not made on time.

“They will post your pictures online to disgrace you before the world. They will call everyone on your contact list to inform them about the private loan you borrowed. But the situation is not the same here. The loan comes with no interest and peace of mind,” she said.

Advertisement

In July, the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) raised interest rate to 26.75 percent — from 26.25 percent. In September, it increased from 26.75 percent to 27.25 percent. Olayemi Cardoso, the CBN governor, said the increase was to subdue inflation.

Muda Yusuf, chief executive officer of the Centre for the Promotion of Private Enterprise (CPPE), had said the hike would be difficult to bear for most businesses and worsen an “already suffocating situation”.

Advertisement

Regina Bamaiyi, chief enterprise officer of the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), told TheCable that as a result of the hike, commercial and merchant banks are expected to adjust their lending rates. She said this may also worsen the ability of entrepreneurs in the micro, small and medium enterprises (MSMEs) sector to access affordable credit.

Bamaiyi said the effect on women, especially those in the informal sector, which comprises 58.2 percent of the economy, could be dire. The most affected women are often street vendors and petty traders who are mostly uneducated and unable to receive loans from banks owing to high interest rates, strict collateral requirements, or proof of salaried employment.

Advertisement

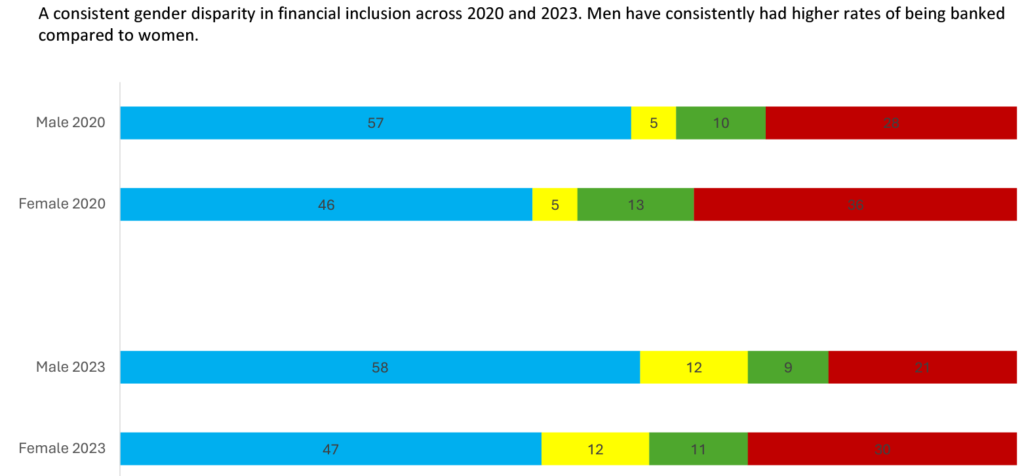

According to a 2023 survey by Enhancing Financial Innovation and Access (EFInA), 30 percent of adult women were unbanked compared to 21 percent of men, which means that out of the 57 million adult women in Nigeria, approximately 17 million are financially excluded.

In a digital credit activation toolkit released by Women’s World Banking, only six percent of women in Nigeria were said to have access to credit, despite access to finance in Nigeria progressing from 56 percent in 2020 to 64 percent in 2023.

The international NGO noted that with 49 percent of the women adult population in Nigeria, women-owned businesses comprise 41 percent of total MSMEs.

The NGO said women typically face higher constraints than men in obtaining loans, particularly because of a lack of physical collateral, which results in less favourable financial terms as higher interest rates, shorter loan duration, and smaller loans when compared to men.

Similarly, the Rockefeller Philanthropy Advisor’s Gender Centre of Excellence, a resource centre, said about 98 percent of Nigerian women are left out of formal credit markets, unable to obtain loans from formal financial institutions like banks.

Hence, these women resort to the informal credit market like cooperative societies which provide collateral-free credit facilities with easy paperwork, and flexible repayment options.

However, some of the informal credit systems come with risks.

COOPERATIVE SOCIETIES AS LIFELINE

When a major crisis hit the association Taiwo Oyebade joined in Lagos state, and she could not retrieve her savings, it dampened her spirit. But she didn’t let the incident weigh her down. When she relocated with her family to Ibadan, the 58-year-old trader joined the Ifedapo Afenifere Cooperative Society in the Kute area of the state capital, where she sells soft drinks and other household items. She is now the coordinator of the group with 56 members.

“The one I did in Lagos, they nearly broke my head. When I was invited to join the current one seven years ago, I didn’t trust anybody again. But they assured me that the cooperative society was safe,” Oyebade said.

“Once you join us and you are doing well, you can apply for a loan for your business after three months. You pay an interest of N15 kobo on every N1,000. The loan must be paid within 10 months. The interest reduces as you pay every month. Before you can get a loan of maybe N100,000, you must have up to N45,000 in your savings. Your two guarantors must have at least N30,000 each in savings. We don’t ask for collateral. So, if you run away with the loan, your savings and that of the guarantors will cover it.

“Again, before another member can stand as your guarantor, you’d have shared the business plans of what you want to use the money for with them, and they have to be convinced. We don’t have to start running after you with the police or threaten you with the court.

“I may not have the exact figure. But this year, we have disbursed at least over N400,000 loans monthly. As members pay back, we give them out immediately to other members who need soft loans.”

Oyebade said the society also gives out loans for household equipment, children’s school fees, or land purchases.

“I’ve got money to buy a television once. When my last child was admitted to the university, I applied for a loan from the society, and that helped with tuition fees and other expenses for her to resume. But people often abuse this particular privilege,” she noted.

“The cooperative also sells lands. We buy land in acres and sell it to members to help them easily build houses. They pay back over a while. But they won’t loan you for burial or trivial ceremonies.”

Though she has a bank account, Oyebade said she has never collected a bank loan because of the bitter experiences she has heard from friends and acquaintances. She has been told about the high interest rates, the stressful documentation, collateral demands, and unscheduled visitations.

“Even the rate at which they deduct money from your account is alarming. Not until I opened my bank app recently to check transaction details that I realised the frivolous deductions. Before, there used to be interest on money saved in the bank, but it’s no longer so. They just deduct your money anyhow,” she said.

“Recently, my bank sent me a text message that I should come and take a N1 million loan, but they will deduct an interest of N150,000 instantly. So, how much is left? But in my cooperative society, I’ve collected N500,000, N600,000 at different times to boost my business, and I didn’t feel choked or have anyone on my neck.”

The sentiment is shared by Jimoh Auwal, the coordinator of Otito-Inu Muslim Cooperative and Credit Society, Ibadan. The 34-year-old musician said she has never collected a bank loan because it heightens her anxiety.

BREAKING SOCIAL STATUS BARRIER

As far as Auwal is concerned, she enjoys the social privilege and other financial benefits the cooperative society offers.

The Olopomeji branch of the association, which started less than two years ago, now has over 40 women members and a few men. The association admits more members during their weekly Wednesday meetings. They had to split into two groups within the compound as attendance grew.

“Here at the cooperative society, if you have some verified challenges that incapacitate you from paying back your loans, we give them a soft landing, and if they also need any other assistance to get back on their feet, we help them. We don’t have to worsen your situation. But a bank doesn’t want to understand your condition for not returning their money at the stipulated time. Moreover, your interest keeps increasing at the bank. Your heart palpitates, and they keep running after you. Your collateral is at risk, and guarantors also start calling you,” Auwal said.

As a musician, Auwal said the association has promoted her brand. Mingling with members within and other branches has helped her with networking. Members patronise one another’s businesses, and this makes the community stronger.

“People who are higher than you in social status, you sit with them on meeting days and deliberate together. Hence, this meeting breaks the social status barrier, and we relate on the same pedestal. The bond and trust become stronger. They call me for their social events to provide entertainment, and I make more money,” she said.

EXPERTS: WHY COOPERATIVE SOCIETIES ARE BECOMING MORE ATTRACTIVE

According to EFInA, cooperatives could be a significant force in empowering rural communities, farmers, women, and micro-entrepreneurs throughout Nigeria. It noted that the rise of cooperative societies in local communities may be attributed to long distances to banks, low literacy, excessive documentation, lack of income, and trust issues.

Emmanuel Atama, the chief executive officer (CEO) of the National Cooperative Financial Agency of Nigeria (CFAN), said over 30 million Nigerians are members of cooperative societies.

“Within the Islamic women, we have about 150,000 of them across Nigeria called the Sisters of Jannah, and I am part and parcel of the process of mentoring them to make sure that they have a sustainable cooperative,” Atama told TheCable.

“Nigerians, at this point, are all looking for ways to help themselves because the system is not helping matters. Things are getting worse every day. So, that is why you see that people are very much interested, and they are coming together to do it, not just in offices but even in religious settings. We have a faith-based cooperative society.

“So, people request self-help, and that self-help is cooperative, where the people come together, put their resources together, and start assisting one another. So, that’s the reason why you see that there is an upsurge in the participation of people in cooperatives and it goes across various aspects of the society, both low, medium, and higher-income earners.

“Even in offices where we felt that people are well paid, even in the oil companies, we discovered that there is cooperative because it helps people to save money in the first place, and at the same time, it gives them unhindered access to finance that is quite cheaper than what is obtainable.

“We discovered that for some time now, running up to one year, the CBN has been trying to discourage lending by upping the interest rates at each of its monetary policy meetings. But since they have moved the interest rate very high, cooperatives ask for lending at single digits.”

Atama noted that one of the major reasons most women find cooperative societies more attractive is because they are inclusive and accommodating.

“As a matter of fact, in cooperatives, we don’t identify a member as a woman or a man. We identify the person as a member. That is why you see that the women are very comfortable with cooperatives,” he said.

“Nobody is shouting at them to sit down and tell them that they are women because our system recognises you as a person and as a member, as one of the owners and as one of the managers. So, it is not a surprise that the women are taking the lead. The issue is that it is a good one, and we continue to encourage it so that our women can be well included.”

Bamaiyi said aside from the cross-guarantee model, most of the cooperative societies thrive on trust. She said SMEDAN has different programmes like ‘One Local Government, One Product’ and ‘Women in Self-Empowerment Project’, targeted at women-led cooperatives.

“These programmes targeted at women-led cooperative societies are taking place in about six states in Nigeria. These cooperatives are selected based on a comparative advantage of what they produce or what they do in that particular state, and they are trained. If they need any form of support, through the need-based assessments that will be done, we will give them,” she told TheCable.

“So, cooperatives that are collecting funds from their members and lending to themselves will begin to thrive more in this particular economy we are in.”

For this reason, women leaders like Auwal and Oyebade will continue to introduce more of their counterparts to their cooperative associations to empower them and ensure they keep their heads above water as Nigeria navigates its way through the prevailing economic turbulence.