“For the past three months now, I haven’t fueled my car,” Fabian Dike, who runs a retail outlet selling wine and other alcoholic beverages, tells TheCable in Owerri, the Imo state capital. He says his car has been parked because he can no longer afford to maintain it. In the past, he filled his tank with N15,000, but today, almost N50,000 will be needed to do the same.

He is not alone, millions of citizens nationwide are making lifestyle changes to survive in the “new” Nigeria. From Ibadan to Yola, from Lokoja to Cross River, from Port Harcourt to Lagos, Nigerians are making hard decisions to survive increased economic hardship as a result of what they call the “twin demons” of subsidy removal and exchange rate instability.

TheCable visited numerous states across the federation to see how the cost of living is affecting people in rural and urban centres. The story is the same across the country — it is double trouble.

Advertisement

IN OYO, IT IS BODMAS FOR BEEF

In her 50s, Sadiyat Tajudeen, who sells baby items at Eleyele Market, says she tactically divides each piece of beef from the original market size, cutting it into two or three more pieces so the protein can last longer for her family.

“I reserve three or four pieces in the original size for the head of the house while I divide others into two or three pieces,” she narrated, stating that her family now finishes a pot of soup after eating just two or three times.

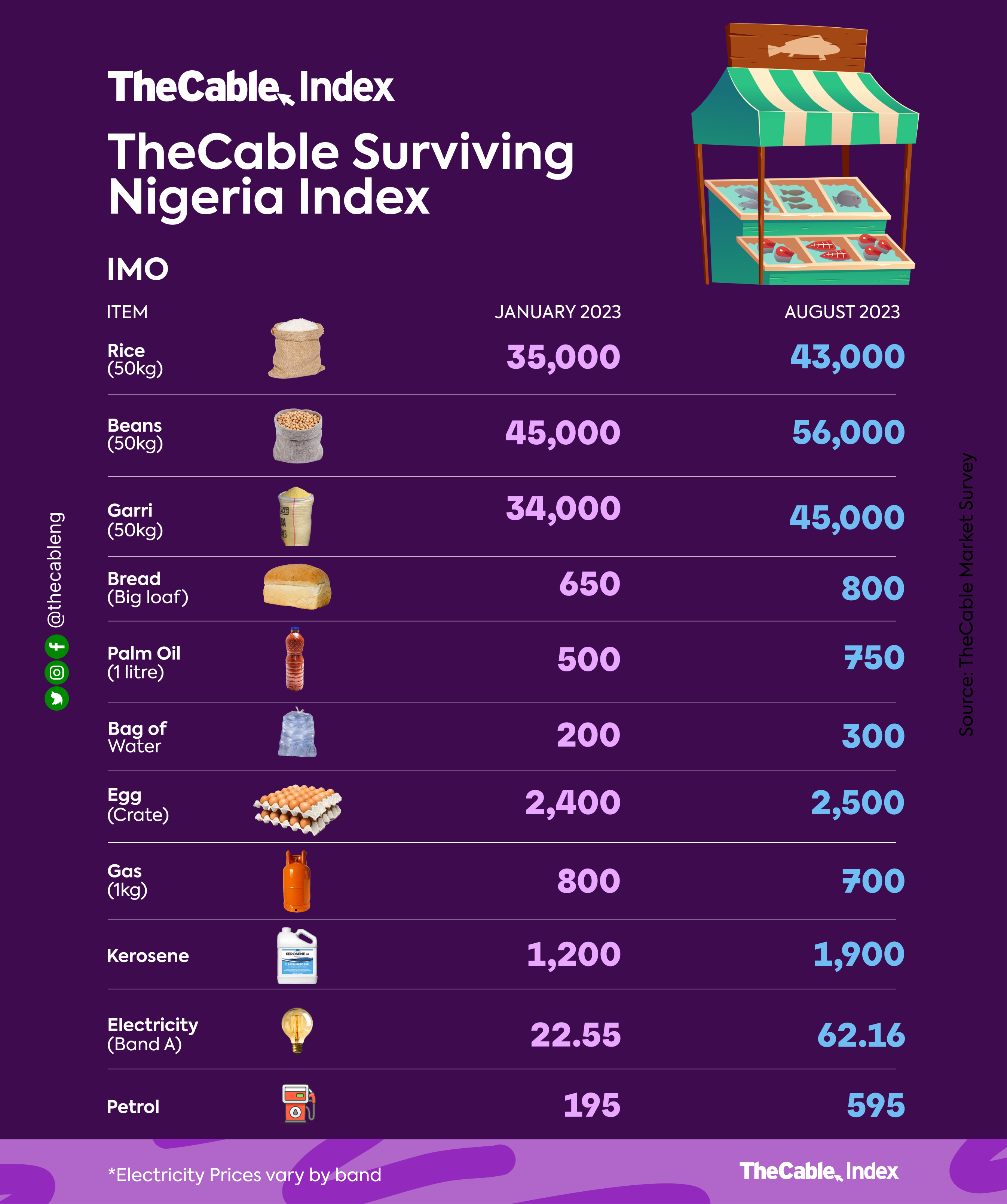

Bashir, who sells grains on a wheelbarrow at another section of the market, said he used to buy three or four bags of rice at N32,000 or N33,000 each in January 2023, but now, he buys the same at N40,000.

Advertisement

“I can only afford to buy two bags at a time,” he told TheCable.

“It’s not that my money is reducing, it is the cost of the products going so high so that we can no longer buy as much as we used to.”

The signature sight of bright red tomatoes and pepper at every corner of Sasa Market is gradually disappearing.

Advertisement

When TheCable visited, there were fewer sellers, but even fewer buyers, which may lead to the death of many small businesses in the market.

Mrs Olarenwaju, who sells carbonated drinks and water alongside her husband, said her family does not make enough sales to renew their rent in the market when it expires.

“We rented this place in July for N100,000. People are not taking up the stalls,” she said pointing to empty stalls. “We that are here, there is no market. Sometimes, we don’t sell up to N1,000 a day. After our rent expires, we’ll pack out and go elsewhere”.

While the Olanrewajus are experiencing some financial strain in their marriage, many Nigerians seeking to get married are having second thoughts due to the economy.

Advertisement

IT IS NO MONEY, NO MARRIAGE IN NIGER

For James Kalu — a trader who was formerly into selling various food items before the economy hit hard — the new reality may mean delayed romance.

Advertisement

He recently switched to selling Garri at Kure Market in Minna, Niger state. With this business, Kalu holds onto a thin thread of hope as he is uncertain if the business will support him enough to get married.

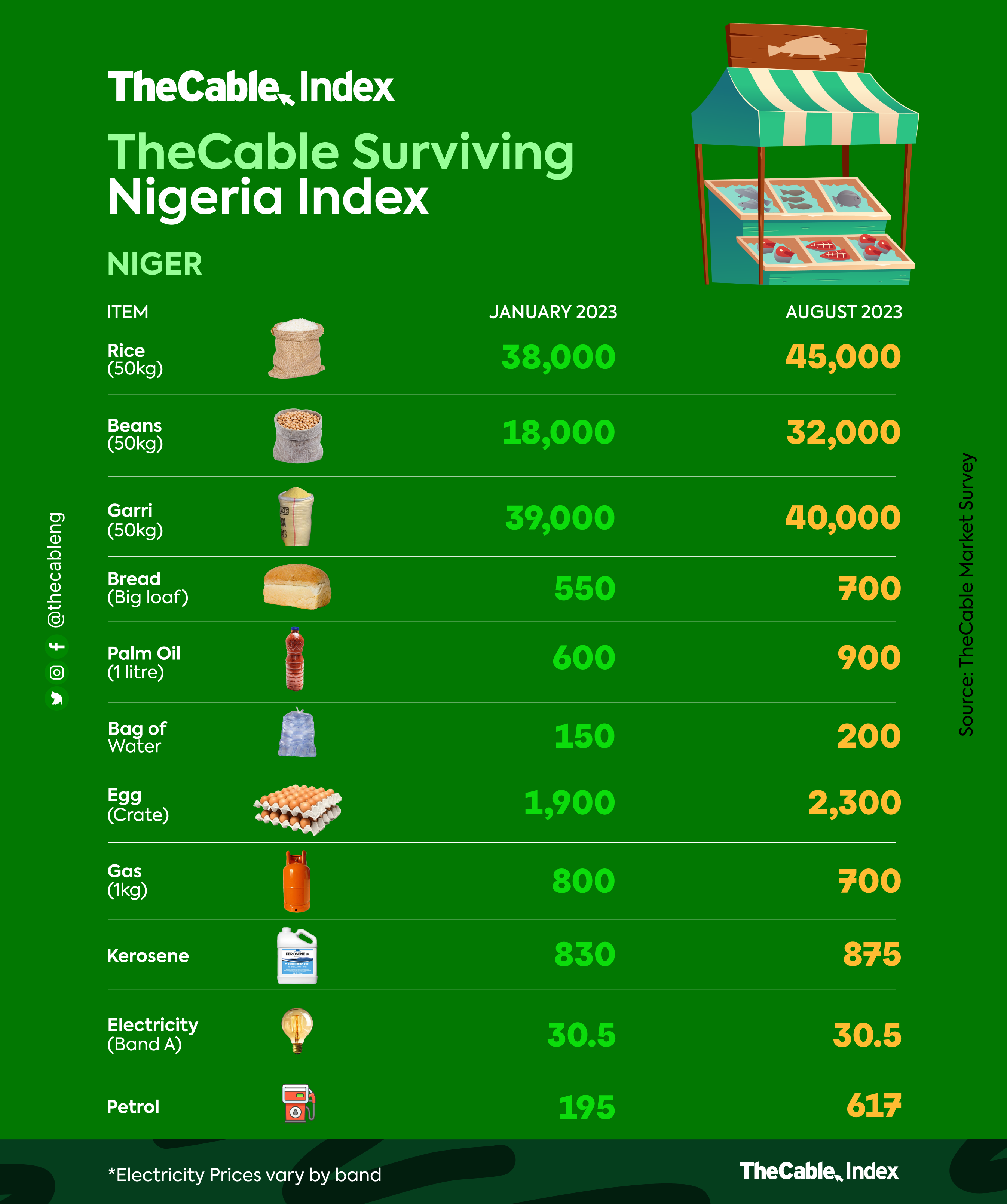

“Early this year, a mudu of Garri was being sold for N250 to N300 but now it’s N600. There is not much profit compared to when it was sold for N250,” he said.

Advertisement

“I wonder how I will be able to gather money from this business to get married. I pray that our God will intervene in this situation.”

NO NEED FOR HEALTH INSURANCE

Advertisement

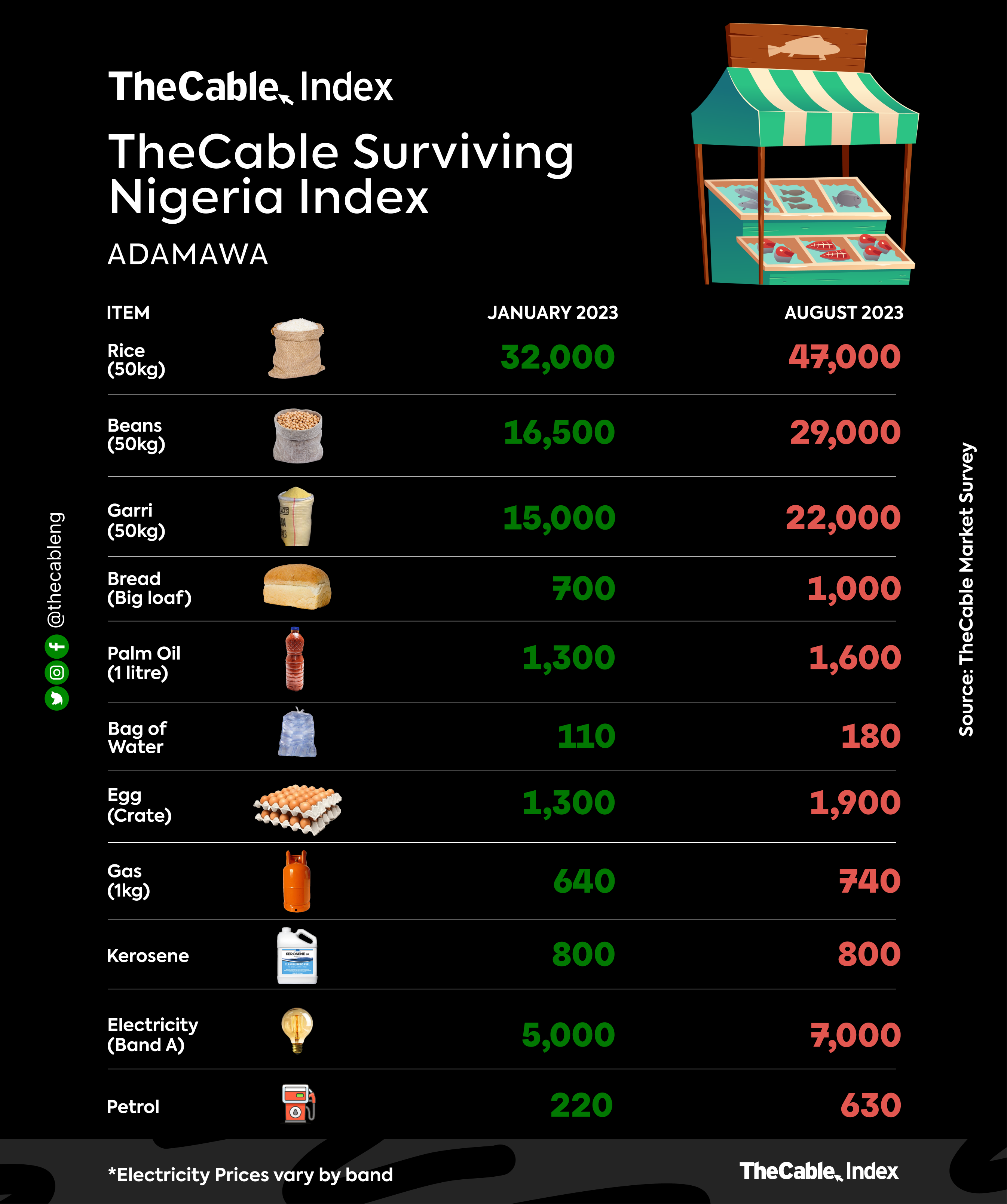

Ibrahim Gambo, a 33-year-old trader selling home items in Yola, is in the same shows as Kalu; both men believe finance has to come before romance. Gambo, who currently resides in his father’s house, said he initially planned to get married this year but is considering postponing due to the challenging economic situation in the country.

Worse still, he is making changes and deep cuts to his spending to reflect the country’s realities — he said he has already cut pay-TV bills, halted the use of his car, and will shut down health insurance payments for himself and his siblings.

“We hardly fall sick in my family, so no need for health insurance,” he told TheCable.

JAPA OVER SAPA IN PORT HARCOURT

Uche lost his job in 2020 during the pandemic, and has been struggling to take care of the people who call him “daddy”.

As a responsible man, he started a cab business to feed his family, with the hope that a new government would change his fortune, but he has been disappointed so far.

“Government is not doing anything. We are on our own,” the father of three said, adding that he has “to look for a way to fend for” his family.

“The taxi business isn’t as profitable as before, especially now that the fuel price has gone up”.

For him, leaving Nigeria (Japa) is the solution to financial difficulties now colloquially referred to as “sapa”— serious absence of purchasing ability.

“I really do not have anything to say about the new government but if I see any opportunity to leave this country, I will leave.”

WAREHOUSES ARE WEARING THIN

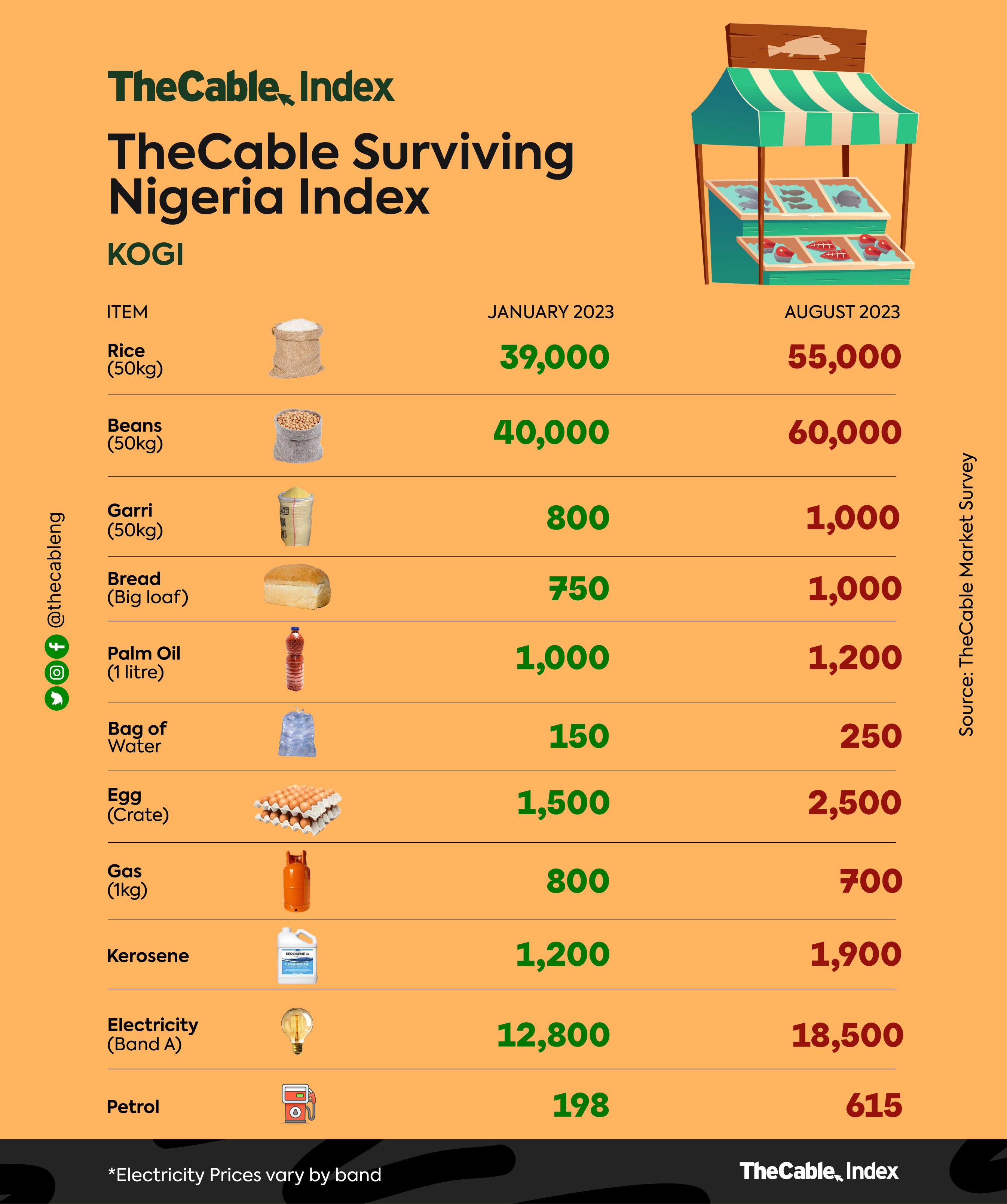

In Lokoja, the hike in the price of commodities has made many middlemen close down their warehouses. Godwin Grace, a petty trader buying from the warehouses, said fast-moving consumer goods companies like Nestle, Golden Penny have increased prices to reflect recent realities.

“Within the period the subsidy was removed and now, one carton of Bama is N4,500 higher. Golden Penny added N400 to all their products. We got another email that they will jack up the price again. With that, all the warehouses in this market have shut their doors,” she said.

“Take Nestle for instance, they have increased the prices of their products twice after subsidy removal. We used to buy Maggi Star for N13,800, it went to N14,300 in August, and now, it is N14,700.”

“Kings Oil 25litres was N30,000 before the Tinubu came in, but now, it’s N34,000. The manufacturer has sent us an email that they will effect a price increase on the 1-litre version of the oil too.”

“This is Lokoja international market. By international, if it was to be before, everywhere is always filled with buyers. Now, the sellers are not around because no money to restock and transport themselves and the buyers too are not coming because of lack of money.”

THE STARVING GIANT OF AFRICA

Lagos is the biggest sub-national economy in Nigeria by numerous metrics — there are over 20 million Nigerians living in the city, and a good number of them are feeling the crunch.

Chinyere Okafor, an oil seller at the Mile 12 International Market in Lagos, says she can no longer afford the luxury of buying a full bag of rice monthly to feed herself and her children – instead, she buys in smaller portions barely sufficient for a couple of days.

With a mix of exasperation and anger, she voiced her grievances, pointing fingers at the government for what she sees as its failure to address the rising cost of living and skyrocketing prices of food items.

Amid the foodstuff market’s hustle and bustle, Okafor’s voice cut through the noise and captured the rapt attention of vendors and shoppers alike.

Her sentiments struck a chord with the crowd, drawing resounding applause and murmurs of agreement from fellow market traders who have also been grappling with the financial strain caused by escalating prices and low sales.

HIGHER PRICES, LOWER PROFITS

For David Umoren, who sells palm oil in bulk at the popular Watt market, Calabar, “things have really changed”. In the past, he made N1,000 on N6,000 worth of palm oil, but now he makes between N500 and N1,000 on N20,000 worth of palm oil.

N20,000 worth of palm oil, which would have landed him N3,000 in profit, now fetches just N1,000. For him, “higher prices not bringing in higher profits”.

Across the country, many of the traders we spoke to responded like Mama Dupe Akanni, a trader in Calabar, who said they could only speak to us because there are little to no sales.

“As you are seated here, I would have stood up ten times to attend to customers. But now, in a whole day, I hardly take N1000 home,” she said.

For many Nigerians, it is no longer about profit, it has simply become about cash flow.

“Sometimes when you get goods from a company like 10,000 and you hope to say like 10,100 or 10,200, before you finish selling the product, the company will say they have an increment of up to 15,000 of the same product, where will you get extra money to add to get the same product?” Obinna asked TheCable in Enugu.

BABA GO FAST HAS GONE TOO FAST?

President Bola Tinubu ran for president with the promise to make life better for Nigerians. He kicked against policies by the Central Bank of Nigeria (CBN), calling interest rates “anti-people, anti-business”.

Upon assumption of office, he removed Nigeria’s unending fuel subsidy and instructed the CBN to drive the unification of foreign exchange rates. Some Nigerians and a lot of the international community immediately lauded him.

The policies were praised so much that Reuters asked if he was Baba Go Fast, the opposite of the nickname handed to former president Muhammadu Buhari for his snail speed policy implementation.

However, less than three months after these policies took effect, Nigerians are worse off. From Yola to Oyo, the song rings true — food prices are getting too high in so short a time.

Obinna, the 35-year-old businessman from Enugu, believes that the Buhari administration was better for Nigeria than the Tinubu administration.

“Since the beginning of the year, things have been a little bit hard and we were thinking that if you have a new president things will be fine or get better because before now, we have been hearing about Tinubu and that he can refine Nigeria to a better place. But after everything, the next thing we saw was hardship more than what we expected,” he said.

“I will say it’s better we go back to the last regime because what we expected from this administration is not what we are getting. The last regime was tough but even as it was tough it was a little better.”

Palliatives to cushion the effect of fuel subsidy removal are not changing local experiences; while some Nigerians are calling on God, others are calling on the government, but Uche in Port Harcourt is finding solace in his faith, which warns of the end times.

For him, the economic crisis in Nigeria “is the fulfilment of God’s prophecy”.

“The system is fulfilling scriptures. Things are not going to get better. It will only grow from bad to worse. We thought Buhari was bad and Tinubu came in, but it is basically going to be the same thing when Tinubu leaves,” he said.

Here is the government’s chance to convince him — and millions of Nigerians.

This is a special investigative project by Cable Newspaper Journalism Foundation (CNJF) in partnership with TheCable, supported by the MacArthur Foundation. Published materials are not the views of the MacArthur Foundation.

Add a comment