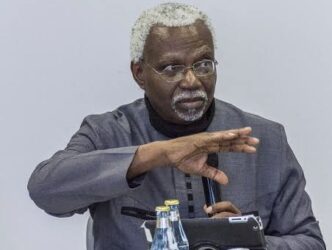

Taiwo Oyedele, chairman of the presidential fiscal policy and tax reforms committee, has given an overview of the economic stabilisation bills (ESBs).

Oyedele announced in a post on X on Tuesday that 10 economic stabilisation bills are seeking amendment of tax policies.

The federal executive council (FEC) approved the economic stabilisation bills on Monday.

FEC approved the tax proposals 11 months after the committee recommended 20 ‘quick wins’ for immediate reforms.

Advertisement

Highlighting some of the recommendations in the bills on Tuesday, Oyedele said the ESBs seek to amend about 15 different tax, fiscal, and establishment laws.

He said the amendment will facilitate economic stability and set the country on the path for sustained inclusive growth.

“The Economic Stabilisation Bills (ESB) which have been approved by the Federal Executive Council contain some recommendations of the Presidential Fiscal Policy and Tax Reforms Committee as part of the Accelerated Stability and Advancement Plan (ASAP) of the government,” Oyedele said.

Advertisement

According to Oyedele, the proposed changes are designed to achieve inflation reduction, price stability, and promote fiscal discipline and consolidation.

Other goals include complementing monetary policy measures with appropriate fiscal interventions to strengthen the naira and sustain exchange rate convergence, enhance job creation and poverty alleviation, as well as improve export promotion and diversification.

Oyedele said the bills will be transmitted to the national assembly for passage into law.

The following are the approved ECBs by FEC:

Advertisement

1. Amendments to the income tax laws to facilitate employment opportunities for Nigerians in Nigeria within the global value chain, including the digital economy.

2. Zero-rated value-added tax (VAT) and improved incentive regime to promote exports of goods, services, and intellectual property.

3. Amendments to facilitate investment in the gas sector and simplify the local content requirements to ensure competitiveness.

4. Reform of the foreign exchange (forex) regime to enhance the regulatory powers of the CBN, unlock more forex liquidity, strengthen the naira, and sustain multiple rates convergence.

Advertisement

5. Tax reliefs for private sector employers in respect of wage awards and transport subsidies provided to their employees.

6. Tax relief to companies that generate incremental employment and retain such employees for a minimum of three years.

Advertisement

7. Fiscal discipline and enhancement of remittances from government agencies and corporations to the consolidated revenue fund of the federal government.

8. Collaboration with states to suspend certain taxes on small businesses and vulnerable populations such as road haulage levies and other charges on transportation of goods; business premises registration; animal trade and produce sale tax; bicycle, truck, canoe, wheelbarrow, and cart fees; shops, kiosks and market taxes and levies.

Advertisement

9. Introduction of “Tax Identification Consolidation and Collaboration (TICC)” initiative to expand the tax base, widen the tax net, and create a level playing field for businesses.

10. Provision of additional funding for the student loan scheme.

Advertisement