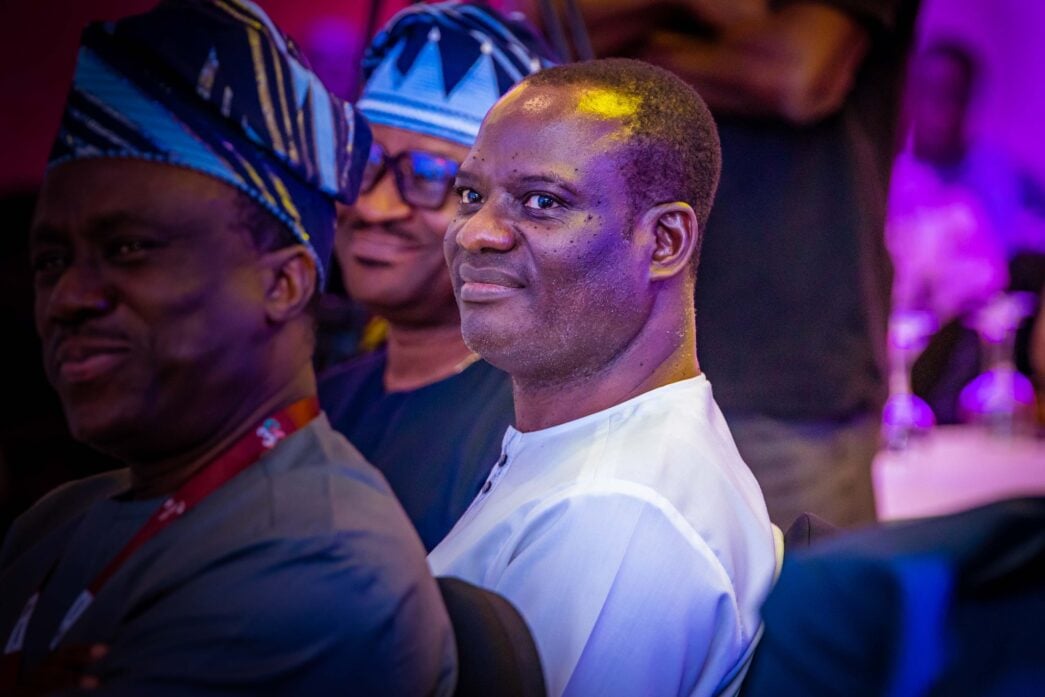

Taiwo Oyedele, chairman of the presidential committee on fiscal policy and tax reforms, at the 30th Nigerian Economic Summit (NES) on October 14

Taiwo Oyedele, chairman of the presidential committee on fiscal policy and tax reforms, says 90 percent of Nigerian taxpayers currently are people who should not be taxed.

Speaking at the 30th Nigerian Economic Summit (NES) on Monday, Oyedele advocated for a more streamlined and equitable tax system in the country.

The fiscal policy expert said the government is prepared and determined to ensure that the right individuals pay taxes, noting that his committee is actively working to achieve the goal.

“People will pay tax once we decide that they have to pay. What we realiase is that almost 90% of people who are paying taxes are those who should not have been paying in the first place,” he said.

Advertisement

“So that’s where we came up with the data that 97% of the informal sector should be formally exempted from taxes. People do not understand where we are coming from.

“They’re not the ones to pay taxes. They’re just trying to survive.”

Regarding how his committee is working to ensure the right individuals pay taxes, Oyedele said the team would utilise primary data identification channels to accurately bring the appropriate group of taxpayers into the tax bracket.

Advertisement

“So the way we are developing the system is first, and I’ll give you a very broad highlight. We’ll use primary data identification, which is the NIN for individuals, and we will use your RC number with the CAC for businesses,” he said.

“We’re developing a system for government and corporations conducting business. Everything you do that constitutes an economic activity will be linked to that data/ID.

“That ID contains information, whether you open a bank account, spend using your payment card, travel abroad, register a vehicle, buy items, or even use your phone.

“So when you declare your income and say you earned N2 million, we will ask, how did you earn N2 million? You spent N40 million. You will have to come and reconcile that for us.”

Advertisement

Oyedele said Nigeria reported an income of N15 trillion in 2023, while consumption in the economy amounted to N200 trillion.

He said the discrepancy does not add up.

“If you take the personal income tax that was declared last year, which was N1.53 trillion as the total personal income tax we collected, if you gross it up, we declared an income of about N15 trillion in an economy where consumption alone is close to N200 trillion,” he explained.

“So even when you disaggregate and take out government consumption and credit for households, it still doesn’t add up.

Advertisement

“This new system has been proven everywhere. It has worked in Kenya, Rwanda, South Africa, and other places.

“So we’ll implement that. We’re giving you the assurance that those who need to pay will pay.”

Advertisement

Meanwhile, TheCable, on October 13, reported that the national assembly is considering a bill proposing an increase in the value-added tax (VAT) from 7.5 percent to 10 percent by 2025.

Advertisement

Add a comment