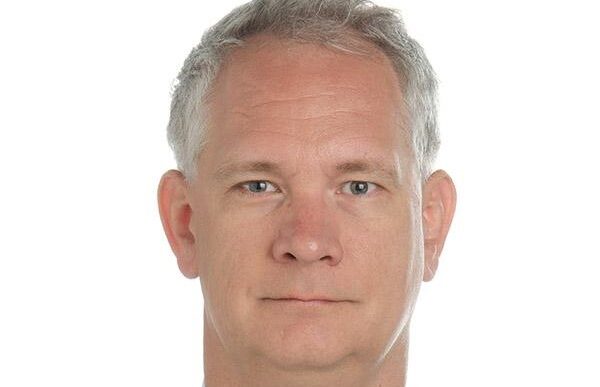

Taiwo Oyedele, chairman of the presidential committee on fiscal policy and tax reforms, says proposed changes in Nigeria’s tax laws will significantly boost revenue.

Oyedele spoke during an interview with Bloomberg on Friday.

On October 3, President Bola Tinubu asked the national assembly to consider and pass four tax reform bills.

The bills include the Nigeria tax bill, the tax administration bill, and the joint revenue board establishment bill.

Advertisement

Also, the bill seeks to increase value-added tax (VAT) to 10 percent by 2025 and reduce company income tax (CIT) to 27.5 percent from an average of 30 percent over the same period.

According to the bill, personal income tax (PIT) will be raised to 25 percent for high earners from next year, from about 20 percent.

Tinubu is also seeking to repeal the law establishing the Federal Inland Revenue Service (FIRS) and replace it with the Nigeria Revenue Service.

Advertisement

Reacting to the development, the Northern States Governors Forum (NSGF) opposed the proposed bills, following a joint meeting with the northern traditional rulers council at the Kaduna government house on October 28.

The governors asked the national assembly to reject any legislation that may harm the region’s interests, calling for equitable and fair implementation of national policies and programmes to prevent marginalisation of any geopolitical zone.

Following the opposition from the northern governors, the presidency on October 31 assured them that the proposed laws were not recommended by Tinubu to disadvantage any part of the country as they were designed to improve the lives of Nigerians and optimise existing tax frameworks.

On the same day, the national executive council (NEC) asked Tinubu to withdraw the tax reform bills to give room for consultations, however, the president urged the NEC to allow the process to take its full course.

Advertisement

Oyedele said the tax reforms would ensure revenue “double within the next two to three years as a share of gross domestic product (GDP)”.

“If we are moving from 9 percent to 18 percent, that means we are doubling it,” he said.

Oyedele said the government would not back down, though elements of the plan could be tweaked.

“The worst case scenario is to drop the controversial issues,” he said.

Advertisement

“There’s an outcome of it going ahead as proposed, or the one that goes ahead with modification, which is okay.”

The federal government had also assured that the four tax bills currently before the national assembly will not reduce the funding and efficiency of agencies.

Advertisement

Add a comment