As 2024 draws to a close, there are a handful of vital economic promises made by the federal government that are yet to be fulfilled.

The majority of the promises were meant to ameliorate the impact of government policies such as the removal of petrol subsidy in May 2023 and the unification of all segments of the foreign exchange (FX) market in July last year — as both policies increased the cost of living in Nigeria.

Reflecting on the months gone by, TheCable looks at some of the promises that were anticipated by Nigerians in 2024 that were never fulfilled.

TAX WAIVER ON ESSENTIAL FOOD ITEMS

Advertisement

One of the most talked-about economic promises of 2024 was the tax waiver on imported essential food items to ease the burden of rising costs for the average consumer.

On July 10, the federal government announced the suspension of duties, tariffs, and taxes on the importation of food commodities as part of initiatives to curtail the prevailing economic hardship worsened by high prices of commodities.

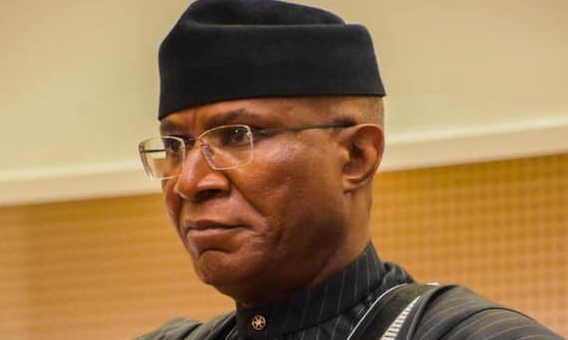

Abubakar Kyari, minister of agriculture and food security, said the measure is a 150-day duty-free import window for food commodities, which involves the suspension of duties, tariffs, and taxes for the importation of maize, husked brown rice, wheat, and cowpeas.

Advertisement

The federal government said the measure would reduce the high cost of food items in the Nigerian market.

On August 14, the Nigeria Customs Service (NCS) announced the implementation of the policy after it received a letter with presidential approval for the initiative to be implemented.

Customs said the duty waiver took effect from July 15 and is expected to end on December 15.

However, on September 6, the NCS said the suspension of duties on imported food items would be implemented as soon as it receives the list of beneficiaries from the ministry of finance.

Advertisement

Five days later, Wale Edun, minister of finance, held a meeting with the customs to discuss the implementation of the zero percent duty on selected food imports.

Yet, implementation is still pending six days to the end of the year.

When contacted, Mohammed Manga, director of press at the ministry of finance, told TheCable he was not in the position to give information on the implementation of the food items waiver.

The waiver was expected to target low-income households, however, as the year progresses, food inflation continues to strain households, with many consumers reporting that the prices of essential items remain high.

Advertisement

In the last consumer price index (CPI) report for November, inflation rose to 34.6 percent while food inflation surged to 39.93 percent.

VAT WAIVER ON HEALTHCARE PRODUCTS

Advertisement

President Bola Tinubu, on June 28, signed an executive order to introduce zero tariffs, excise duties and value-added tax (VAT) on imported pharmaceutical inputs.

Muhammad Ali Pate, coordinating minister of health and social welfare, said the order is aimed at revitalising the Nigerian health sector and increasing the production of healthcare products.

Advertisement

Four months later, Tunji Alausa, minister of state for health and social welfare, said the federal government had finalised the executive order to implement zero VAT and excise duties on imported pharmaceutical products and medical devices.

However, the price of pharmaceutical products is still on the highest side as the federal government has yet to implement the policy.

Advertisement

21% INFLATION RATE

In January, Olayemi Cardoso, governor of Central Bank of Nigeria (CBN), said inflationary pressures were expected to reduce in 2024.

Cardoso said the inflation rate will be reined in and drop to 21.4 percent before the end of the year.

He said the decline in the inflation rate will be achieved through inflation-targeting policy, improved agricultural productivity and the easing of global supply chain pressures, which he said would benefit businesses by boosting consumer confidence and purchasing power.

The CBN governor said the apex bank will also use monetary policy instruments, such as the monetary policy rate (MPR), to curb inflation.

However, according to the National Bureau of Statistics (NBS), as of November, Nigeria’s inflation rate is 34.6 percent — the highest in 28 years, despite raising the interest rate five times this year to tame it.

MULTIPURPOSE DIGITAL IDENTITY CARD

On April 6, the federal government unveiled plans to launch a multipurpose national identity card.

The identity solution will be equipped with payment capability for all types of social and financial services.

The initiative was a collaboration between the National Identity Management Commission (NIMC), the CBN, and the Nigeria Inter-bank Settlement System (NIBSS).

The commission also said only registered citizens and legal residents with the national identification number (NIN) will be eligible to request the card.

Nine months after the unveiled plans, the promise has yet to see substantial progress.

Meanwhile, NIMC on November 22, said Nigerians will have to pay for the new multipurpose national identity card due to limited government revenue.

FINANCIAL AUTONOMY FOR LOCAL GOVERNMENT

On July 11, the supreme court ruled that the federal government can disburse funds from the federation account directly to the local governments, bypassing the state governments.

The apex court also ordered the federal government to withhold allocations to local governments governed by unelected officials appointed by a governor.

Speaking on the matter on July 25, Wale Edun, the minister of finance, said there were “practical impediments” to the implementation of direct payment of allocation to local government areas (LGAs) from the federation account.

The minister had said the process is still in its early stages.

On August 20, the federal government inaugurated a 10-member inter-ministerial committee to enforce the supreme court judgement granting financial autonomy to the local governments.

Five months later, the federal government is yet to implement the financial autonomy of local governments as affirmed by the supreme court.

Add a comment