Access Holdings has become a symbol of transformation in Nigeria’s financial landscape. From modest beginnings to its current position as a dominant force in Africa’s financial landscape, the company’s journey has been defined by strategic initiatives, visionary leadership, and an unwavering commitment to excellence.

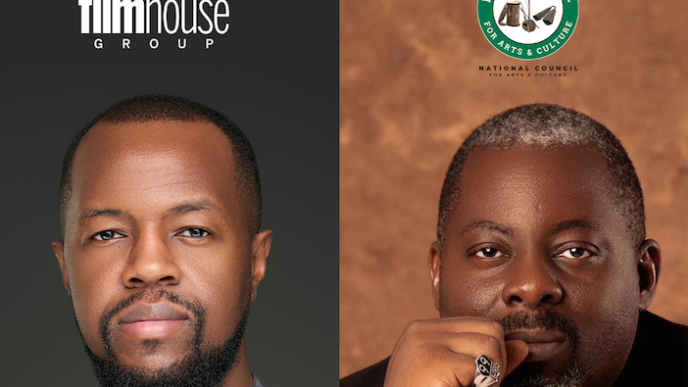

The story of Access Holdings (originally Access Bank) began in 1989, when it ranked in the mid-60s amongst the 89 banks in Nigeria. With just 27 branches nationwide, the path ahead was challenging. However, the bank’s trajectory took a significant turn with the arrival of visionary leaders AigbojeAig-Imoukhuede and Herbert Wigwe in 2002.

Their leadership ushered in a transformative era, guided by a clear vision to elevate Access Holdings into a world-class financial services provider—a vision that continues to shape the company’s success today.

The Seven Pillars of Transformation

In their pursuit of excellence, Aigboje and Wigwe introduced the Seven Transformation Agenda, a strategic framework designed to propel Access Holdings to the forefront of Nigerian banking. This agenda served as a detailed roadmap, carefully charting the course towards greatness.

The agenda focused on seven critical areas:

1.Building a Strong Management Team: Assembling top-tier professionals to lead the bank toward its ambitious objectives.

- Cultivating a Culture of Excellence: Establishing a corporate ethos rooted in professionalism and integrity.

- Investing in Human Capital Development: Prioritising training and development through initiatives like the Access Bank School of Banking Excellence.

- Implementing Efficient Processes: Developing robust systems to streamline daily operations.

- Fostering a Customer-Centric Organisation: Prioritising customer satisfaction and loyalty.

- Innovating Low-Cost Liability Strategies: Creating financial products and services that attract and retain customers.

- Rebranding and Strategic Positioning: Redefining the bank’s image to reflect its new direction and aspirations.

These initiatives yielded rapid results, propelling Access Holdings from its modest beginnings to become one of Nigeria’s top ten banks by 2007. The company achieved a remarkable 115% growth in balance sheets, delivered unprecedented dividends, and delighted investors.

Cyclical Goals: Setting and Achieving Milestones

Access Holdings operates on a model of cyclical objectives, setting five-year goals to ensure continuous improvement and strategic alignment. These objectives have been crucial in guiding the bank’s growth trajectory:

- 2002-2007: The first cycle focused on building a strong foundation. The bank aimed to become a benchmark for service delivery, dominate foreign exchange and money market operations, and establish itself as an employer of choice. By 2007, Access Holdings had achieved these goals, securing its place among Nigeria’s top ten banks.

- 2007-2012: The second cycle emphasized becoming one of Nigeria’s top five financial service providers. The bank sought to lead in project and structured finance, e-business support, and trade finance. These objectives were met by 2012, solidifying Access Holdings’ reputation as a leading financial institution.

- 2013-2017: The third cycle targeted achieving top-three status by all financial metrics, maintaining high credit ratings, delivering exceptional customer experiences, and gaining global brand recognition. By 2017, Access Holdings had accomplished these goals.

- 2018-2022: In the lastcompleted cycle, Access Holdings focused on consolidating its position as Nigeria’s number one bank. The emphasis was on digital literacy, global partnerships, and unparalleled customer satisfaction. By 2022, the bank had secured its status as a retail banking leader and expanded its operations to 12 countries.

- 2023-2027:Access Holdings’, current strategic cycle highlights its intention to become Africa’s gateway to the world, anchored on its plan to position itself as the preferred trade financier and payment facilitator. To this point, the Group has undergone strategic acquisitions across the African continent over the last 16 years. Slowing the pace of these acquisitions, the focus will shift to consolidation aimed at improving market position and boosting returns.By 2027, however, aims to have established a presence in at least 26 countries, of which three would be Organization for Economic Co-operation and Development (OECD) countries supporting trade (United Kingdom, France & USA).

Prospects

According to Proshare reports, in Q1 2024, Access Holdings’ net interest income (+189.4% YoY to N275.7bn) and NIM (+30bps to 6.4%) rose materially. These increases highlighted the accretive benefit of the higher interest rate environment (+600bps increase in MPR to 24.75%) on the banks’ topline, with interest income contributing the bulk (75.8%) of gross earnings. The analysts project that by FY 2024, Access Holdings will record the highest interest income print among tier-1 peers, a testament to its sizeable interest-earning assets.

If the Group’s solid track record is anything to go by, one can almost guarantee that the financial institution will realise its objective of becoming an African aggregator by building global payment gateways and offering comprehensive trade finance support. The Group’s focus on digital transformation, capital accumulation, and strategic expansion reflects its commitment to capturing opportunities across the continent and supporting international growth. As Access Holdings looks to the future, its commitment to impact, innovation, and global prominence promises to drive continued success and positive change in all its existent markets and beyond.

Add a comment