BY JOHNSON AREKPO

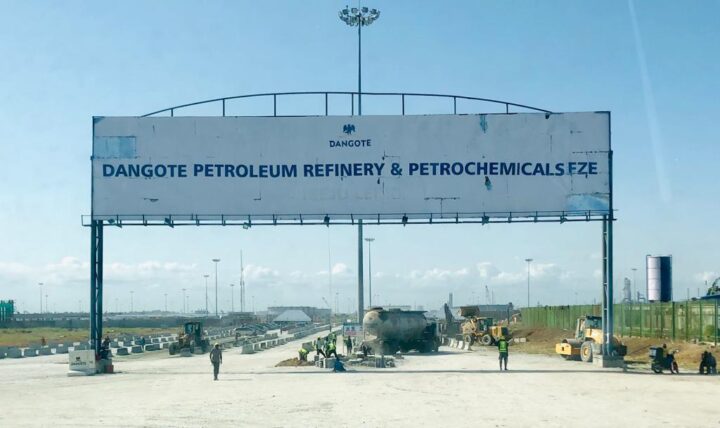

When the Dangote Refinery, the largest single-train facility in the world and valued at over $20 billion launched operations in Lagos last year, it was heralded as a turning point for Nigeria, billed to release Nigeria from the shackles of fuel import dependency. However, recent unverified allegations of a ticketing fraud scandal that reportedly forced the refinery to suspend Premium Motor Spirit (PMS) loading have exposed a far more insidious risk and reignited debates about the danger of entrusting Nigeria’s energy security to one single player.

Dangote Refinery’s suspension of Premium Motor Spirit (PMS) loading was triggered by the discovery that trucks were smuggled out with falsified documents. The Dangote refinery has disputed these claims, but the allegations remain and lack independent confirmation. They also spotlight broader concerns about oversight in infrastructure critical to Nigeria. Notably, the refinery has faced criticism for refusing third party audits or independent testing of its processes. Critics argue that this stance undermines accountability and fuels suspicions of opacity.

The suspension of PMS loading amplifies long standing warnings from energy experts that accuse the Dangote group of trying to monopolise Nigeria’s fuel market through questionable pricing tactics and lawsuits. Whether or not the fraud claims are substantiated, this controversy underscores why no private entity, especially one tied to a single individual, should wield power over Nigeria’s energy and lifeline. For a country already struggling with systemic vulnerabilities, the lack of transparent oversight risks exposing Nigeria to more crises should a centralised system fail.

A Nation Held Hostage

Advertisement

Nigeria’s fuel supply chain is already strained and now faces scarcity risks. Industry analysts estimate that a prolonged halt to the refinery’s operations could drain the country’s reserves within weeks, paralysing its commerce and transportation. If four trucks could slip through a supposedly state-of-the-art system, is there a risk of larger and more ambitious manipulations?

There is speculation that the loading system’s infrastructure is outdated. Another assumption is that middle managers in the refinery owe their jobs to patronage rather than competence. These vulnerabilities in a monopolised system in such a critical industry are not just operational risks but threats to Nigeria’s national security.

In 2021, a ransomware attack on Colonial Pipeline’s infrastructure disrupted 45% of the U.S.’ East Coast fuel supply. Now imagine the same event and the chaos that would ensue if Nigeria’s sole major refinery faced a cyberattack or internal sabotage. Without competitors and a healthy supply chain, Nigeria would grind to a halt.

Advertisement

The Monopoly Gambit

For decades, Nigeria paradoxically imported nearly all of its refined petrol due to defunct state refineries and corruption. The Dangote refinery’s promise to end this paradox was and is seductive. The refinery, which has a 650,000 barrel-per-day capacity, was positioned as Nigeria’s knight in shining armour. It pledged to meet Nigeria, Africa’s largest oil producer, entire demand while exporting surplus and helping the country rebuild its foreign exchange purse. The public hoped. Politicians cheered. Dangote became a king.

But, there are cracks in this narrative. Dangote refinery has lobbied aggressively to ban petrol imports and is currently in court with lawsuits against the Nigerian Midstream and Downstream Petroleum Regulatory Authority for allowing competitors including the NNPCL import fuel. The lawsuits allege that NMDPRA’s issuance of import licenses violates the Petroleum Industry Act (PIA), which prioritises local refining. But this interpretation of the PIA is self-serving. The law encourages domestic production. It does not mandate a monopoly. This lawsuit is one of several steps to eliminate the competition.

The refinery’s recent price cuts have reduced the costs of PMS by around 30% which while looking consumer-friendly on the surface, is actually a long-term monopolistic strategy aimed at pushing out competitors. The Dangote Refinery is effectively subsidising fuel; a move that is unsustainable for independent importers that are already grappling with foreign exchange shortages.

Advertisement

This strategy is already paying off, as rivals without the cushion of a spare couple of billion dollars are being undercut, with some already coming out with statements talking about their loss of business.

This playbook is eerily familiar. In the 19th century, Standard Oil used similar tactics to monopolise the American energy sector. John D. Rockefeller slashed prices to bankrupt competitors before hiking them as soon as market dominance was secured. This appears to be what is in play in Nigeria, making it a matter of when the Dangote refineries will dominate the market and then control prices.

This is not paranoia. It is a precedent. Dangote Cement controls about 60% of Nigeria’s market and has long been accused of price fixing. Despite the Federal Competition and Consumer Protection Commission investigating the firm for anti-competitive practices, cement prices are still exorbitant and regulators have done nothing.

The Global Context

Advertisement

However, Nigeria is not alone in facing monopoly risks. In Mexico, Carlos Slim’s dominance of the telecoms sector was accused of stifling innovation for decades. In Venezuela, nationalised oil production under the PDVSA has been used as a political tool for successive regimes. Dwindling output and corruption have left the country reliant on imports. This is a cautionary tale of centralised control. While the Dangote refinery is private, Nigeria risks similar pitfalls. There is a lack of transparency, accountability and redundancy.

Fans of Dangote and blind capitalism will argue that the Dangote refinery brings efficiency and investment. Why can’t a successful businessman lead Nigeria’s energy transition? After all, NNPC’s refineries haemorrhaged billions for decades.

Advertisement

But efficiency without competition is a Faustian bargain. The popular adage goes, “Don’t put all your eggs in one basket.” A single refinery, no matter how efficient, cannot guarantee resilience. Diversification; through multiple private refiners and import allowances coupled with robust public infrastructure will be the bedrock of Nigeria’s energy security.

Also, Dangote’s political influence cannot be ignored. He has maintained a proximity to power and has advised every president since 1999. This raises concerns about regulatory capture.

Advertisement

What now?

To avert a crisis, Nigeria must act decisively:

Advertisement

● Halt Anti-Import Lawsuits: The NMDPRA must not bow to legal intimidation and maintain a competitive market. The only way an import ban will be implemented should be through consensus, not coercion.

● Strengthen Antitrust Laws: The FCCPC must investigate instances of predatory pricing and penalise all anti-competitive behaviour in the market; Dangote or otherwise.

● Encourage Competitors: Incentivise modular refineries and foreign investment. The upcoming Port Harcourt refinery to be managed by Italy’s Maire Tecnimont is a good start towards a balanced future.

● Enforce Transparency: Mandate and enforce third-party independent audits of the Dangote refinery operations and pricing models as well as publish guidelines for the public and all market players.

The Dangote Refinery fraud scandal as unfortunate as it is, is a wake-up call. There is a lot of work the Dangote refinery has to do to ensure there are no repeat instances of fraud.

The Dangote refinery is a Nigerian refinery by a Nigerian for Nigerians and its success is important to the future of Nigeria’s energy security. But, Nigeria’s energy security can not hinge on one player’s ambition or the integrity (or lack of) of his database. Monopolies historically breed complacency, corruption and vulnerability. These are not outcomes Nigeria and her 220 million residents can afford.

As Dangote races to consolidate power, the regulators must choose: Will Nigeria become a captive market for a corporate titan? Or will Nigeria become a diversified economy where competition fuels progress?

We do not know yet. But, the answer will determine whether Nigeria in the long run will stand tall or fall victim to myopia.

Arekpo, a public affairs analyst, lives in Lagos.

Add a comment