Sometimes I wonder how posterity would regard this period of Nigerian history. These are certainly not the best of times, putting it mildly, for majority of the citizens. At this rate, leaders at various levels of government can only wish that they be treated kindly when their deeds and misdeeds are recalled in future. Tough decisions concerning things that affect us all must be made, I agree. The problem, however, has always been whether adequate impact assessments are conducted to factor in the interests of the people. The last one year has been particularly tasking for Nigerians as they attempt to make meanings out of their governments’ social and economic policies.

As if that isn’t enough, now comes the long-awaited halting of petroleum products’ subvention by the federal government. Its origin dates back to the military era, confirming one national indulgence with roots too deep to undo with only minute chances of escaping hostile consequences. We now also know why previous administrations showed different degrees of impotence anytime they were faced with taking definitive stands on the policy.

To demonstrate the intriguing nature of this issue, President Muhammadu Buhari, arguably one Nigerian leader blessed with the image of courage, is set to settle the matter, once and for all. That he has chosen the final hours of his eight-year stay in power to remove oil subsidy must be of interest to political and psychoanalytical scientists. Suffice it to say that many analysts have dismissed the impending removal as selfish and inconsiderate of Buhari. But if one pities the incoming president, what of the masses who are about to witness the kind of hardship they probably haven’t experienced in their lifetime? The many implications of this resolution are indeed too hot to handle. It’s not that the handling of any other aspect of this all-important, tremendously critical industry is any easier, though.

Since oil was discovered in Nigeria in commercial quantity just before independence, the nation and its people have gone through discomfiting cycles of good and bad times. Their fortunes have seen ups and downturns at the mercy of domestic and international vagaries, some unavoidable but others totally needless. A large part of the reading of our political economy would surely include a wholesale departure from non-oil products and services, things that once gave us respectable spots in foreign markets and ensured robust local productivity, employment and development, to the present over-reliance on the black gold. Nigerians can’t seriously be proud of the outcomes of this self-imposed quagmire. Hardly would you find other oil producers in the mould of Nigeria that are in our kind of desperation and corporate distress.

Advertisement

If we have cause to worry about the poor management of our resources in relation the living standards, the dark prospects of more manifestations of penury should keep us awake endlessly. Experts have warned that the pump price of petrol could go as high as N750 in June this year! One quick way out is for the Central Bank of Bank (CBN) to give petroleum importers access to foreign exchange at official rates. Even at that, we’ve been told not to expect anything below N500. The double jeopardy here is that while the government is struggling to woo buyers of crude oil, many individuals, families and institutions are just waiting helplessly to be overwhelmed by suffering.

The strikes in France by refinery workers have made matters worse. At least 25 shipments of the nation’s crude currently search for customers. Each of them accounts for about one million barrels. Work the arithmetic and the country’s bleeding becomes stark. With this picture of expanding lack, we’re stuck with scavenging for solutions by all means. What looks like a low-hanging fruit is to stop the subsidy and damn whatever repercussions will emerge. Two types of subsidy are said to be in operation in the country at the moment. One is the settlement of the difference between the official pump price of Petroleum Motor Spirit (PMS), determined after considering the landing cost and existing margins. The second is the transportation cost paid per litre (about N30). The reasoning here is to achieve some equity in how much the product is sold across the federation. The last point falls flat in the face of logic as the gaps that obtain at various locations nationwide are anything but equitable.

The reality is that only Abuja, Lagos and few other cities enjoy the regulated prices at the Nigerian National Petroleum Corporation (NNPC) outlets and some major marketers. While they sell petrol around N195, there are reports of outrageous pricing that goes as high as N350. These figures are even at ‘peace’ times. Periods of scarcity throw up amounts that assault common sense and humaneness. It is at such times that the pain of spending incredible hours and days in search of patrol mingle with holes in pockets to form a perfect recipe for self-pity and country or leadership loathing. These contradictions actually aggravate an already troubling situation. As subsidies flow unchecked, in ways that shame Father Christmas, the people for whom the wanton sacrifices are made can hardly point to any meaningful benefits that have accrued to them.

Advertisement

A cursory look at some budgetary details would trigger the apprehension and anger of every genuine lover of the nation. In the 2022 federal budget, capital expenditure stood at N5.4 trillion while subsidy which was initially projected to gulp N4 trillion, eventually took a whopping N7 trillion down with it. And, by the estimation of this year’s allocation, subsidy in the first half is billed to consume N3.6 trillion. This grim assessment doesn’t need any supporting argument to prove the unsustainability of the scheme. That Nigeria has bled continually for decades under these hazy circumstances should bother right-thinking citizens and outsiders who wonder why government after government have shied away from taking firm actions to halt these ruinous aberrations.

The Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed, revealed at some fora that the Federal Government had been borrowing funds to pay for petrol subsidies. Although that is hardly surprising to economic watchers, it underscores the precariousness of our macro economy. The last official pronouncement about the country’s debt profile puts it at N77 trillion. If that doesn’t jolt anyone, what else would? Our decision makers who are mostly in their 50s and above have more or less eaten their own future and that of their children, grand-children and, possibly, great grand-children. It’s one thing to borrow and another thing to do so for valid reasons. The real tragedy of our embarrassing status is taking such staggering monies and spending them on recurrent shopping lists, including subsidies. Sadly, Nigerian governments are not known for prudence. We’re now compelled to learn that profligacy can’t be a virtue under any circumstance.

The worrying facts we’re confronted with should clear any doubts about the viability and pertinence of the outright discarding of the subsidy, an instrument since trashed as manifestly fraudulent. I have carefully thought of the crippling adversities that lie ahead of the average residents of Nigeria and come to the conclusion that even though morality has no significant place in capitalism, it won’t be out of place to appeal to the government and other main players in the oil sector to seriously consider the precarious conditions of the populace whose chunk holds the inglorious tag of the world’s most multi-dimensionally poor. With inflation, joblessness and widespread misery certain to shoot up astronomically, genuine salvation is yet to appear on the horizon. At this point, one can only hope that the Nigerian spirit, that never-say-die attribute, would come to the rescue. Yet again.

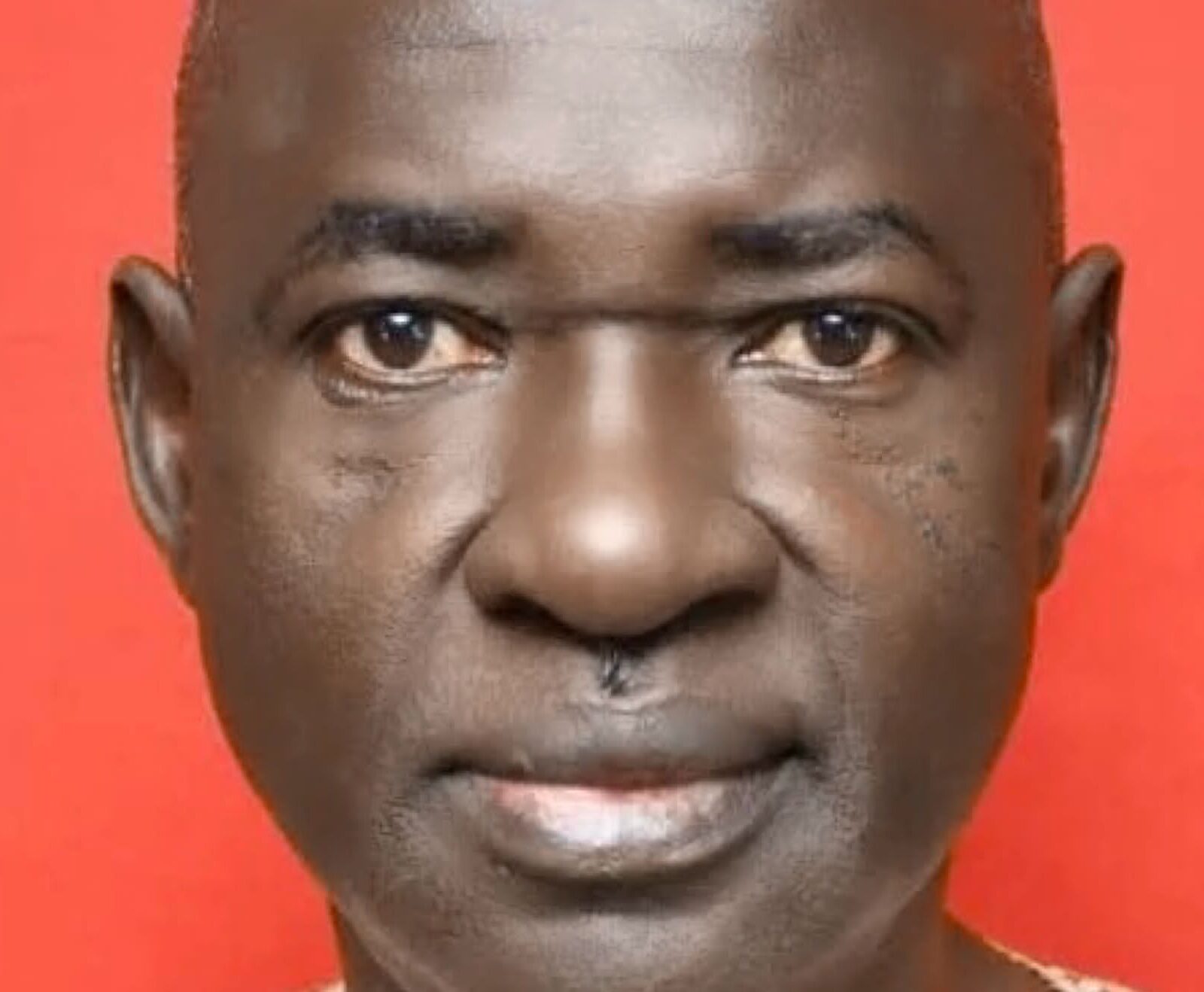

Dr Ekpe is a member of THISDAY editorial board.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.