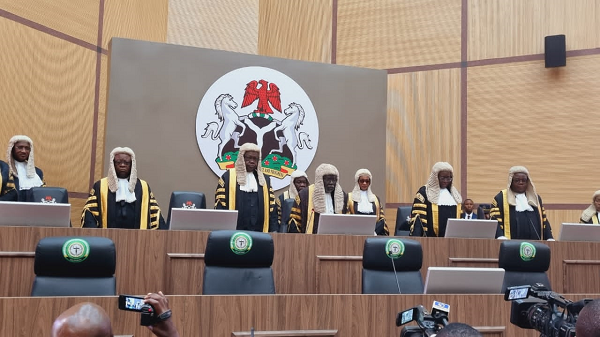

On Wednesday, the Supreme Court of Nigeria entered an interim order against the Central Bank of Nigeria banning the Bank from going ahead with its deadline for the end of use of the old naira note until February 15, 2023, five after the deadline set by the Central Bank. This order was granted Exparte, which means the Supreme Court did not hear from the Central Bank or an agent of the federal government. The court restrained the bank from going ahead with its policy ending the use of the old notes as from February 10, 2023.

Several issues arise from this order. First, is the jurisdiction of the Supreme Court to entertain the suit of the three northern states against the Central Bank of Nigeria. The Supreme Court has appellate jurisdiction over matters of law and on appeal from the Court of Appeal. It has original jurisdiction on two issues. First, it has original jurisdiction on legal dispute between states or between states and the federal government. By recent amendment of the constitution, the Supreme Court now has original jurisdiction also on the disputes between the National Assembly and the Federal Government.

The language of Section 232 (2) of the Constitution that confers original jurisdiction on the Supreme Court on disputes between the States and the Federal Government needs to be examined to ascertain whether the Supreme Court rightly assumed jurisdiction in this matter. It states “The Supreme Court shall, to the escalation of any other court, have original jurisdiction in any dispute between the Federation an a State or between States if and in so far as that dispute involves any question (whether law or fact) on which the existence or extent of a legal right depends”. What amounts to a ‘dispute between the Federation and a state” and what dispute will pass the constitutional muster in the language of the constitution.

First, it must be a dispute between a State or States and the ‘Federation’, not with an agency or department of the federal government. To support this point, we look at Section 251 of the Constitution that created the jurisdiction of the Federal High Court over economic and commercial issues involving departments and agencies of government. The constitutional purpose of Section 232 if to provide a special forum for adjudicating disputes about the extent of the powers of the federal and state governments. So, for the special jurisdiction of the Supreme Court to trigger, there must be a dispute between the federal and states in which the extent of the power of the federal government vis-à-vis the state is to be determined.

Advertisement

The cases where this special jurisdiction has been triggered show that it is usually about efforts by the federal government to aggrandize power to the detriment of the states. This could take the form of usurpation of the powers reserved for the state by the constitution or extending the exercise of federal power in a manner that undermines the authority of the states. Any of these situations gives rise to a dispute between the state and federation. A notable instance of such disputes is the case of the Attorney General of Bendel v. Attorney General of the Federation, the states got the Supreme Court to exercise jurisdiction to nullify the Appropriation Act which was unconstitutional signed in law by the President without passage by two chambers of the National Assembly in joint setting as required by constitution. This is a typical case of aggrandizement by the federal executive contrary to the constitution. In another case of the resort to the original jurisdiction of the Supreme Court in AG (Rivers) v. A.G. Akwa Ibom and A.G. Federation NWLR (Pt. 597) 1023, the dispute was the configuration of boundaries that resulted in Rivers State losing oil wells to Akwa Ibom State. The Supreme Court rightly triggered its original jurisdiction because it involved disputes about rights and entitlement between two states. In A.G. Anambra v. A.G. Federation (2005) FWLR (Pt. 268) 1557, the Supreme Court refused to trigger its original jurisdiction to make others against states that had no disputes with the federation at the suit of Anambra state.

If you consider the facts of the case, there is no abridgment of the rights and entitlement of the three states that approached the Supreme Court in any manner by the federation. There is no action of the federation that is being alleged to have caused special harm or special deprivation in those states. The issue borders on the exercise of regulatory power over currency, an issue within the exclusive jurisdiction of the federal government under the 2ND Schedule to Part 2 of the Constitution. By virtue of Section 251 of the Constitution, the proper court to exercise jurisdiction over matter of currency between the agent of federal government and any person or entity is the Federal High Court, not the Supreme Court. As long as the matter is on a currency policy by the federal government, the proper venue for adjudication is the Federal High Court, not the Supreme Court.

The process by which the three northern states brought the matter to the Supreme Court is a duplicitous one to evade the proper jurisdiction. By not suing the Central Bank and the commercial banks, although they are the real focus of the suit, the plaintiffs go to the Supreme Court under the umbrella of the Attorney General of the Federation as the defendant. In the circumstances, the Supreme Court could reject to hear the case and ask the plaintiffs to add the Central Bank and proceed to the Federal High Court to seek both interlocutory and final orders. This would have been the best judicial direction that would have given the Central Bank to contest the case on merit. The notion that the Attorney General of the Federation is the chief law officer of the federation does not mean that he has to defend suits at the instance of statutory agencies that exercise their mandate based on law. Those agencies should be sued in their own name, especially when they are independent agencies whose relationship with the federal government is necessarily distance in order to achieve the strategic independence required for good monetary policymaking.

Advertisement

The Supreme Court ought to refuse to take on the case in its original jurisdiction because it is not the sort of matter that the constitution prescribed to be taken on the original jurisdiction of the Supreme Court. Again, the plaintiffs’ lawyer argued that the case was premised on the general suffering of Nigerians on account of the naira redesign policy and warned that anarchy looms. The problem is that none of the states have significant or overwhelming responsibility to manage the so-called anarchy. There is no special right of theirs that have been threatened by the presumed anarchy arising from the policy that needs protection and there is not special disability they allege that the policy from the federal agency has imposed on them as to constitute a real dispute between them and the federation to trigger the original jurisdiction of the Supreme Court. For all these reasons the Supreme Court ought to refuse to trigger its original jurisdiction.

The second error of the court in my view is to grand the interlocutory injunction in the manner it did. Of course, the court always has the power and the duty to issue a preservatory order at any time in the course of proceedings as long as it is meritorious. But the question is whether an interlocutory injunction reversing the deadline of the CBN without hearing the defendant is right in the circumstances of the case? I do not think so. First, the policy by the Central Bank ought to take effect on February 10. That policy seeks to end the validity of the old note on that day. The Supreme Court orders on February 8 that the policy should be stayed until February 15, when the defendant, the Attorney General of the Federation can enter appearance. The implication of the interim order is that the court has nullified in the interim the policy of the CBN and has granted the plaintiff the relief they want, albeit for a short period.

This sort of far-reaching order should never be granted without hearing the other party. The Supreme Court could have stepped the matter down for a day or two to hear the defendant before such order that seem to reverse the order of the CBN. The balance of convenience and merit in the case would have required the exercise of discretion to permit the defendant to be heard before the interim order is granted, considering that basically grants the plaintiffs their relief in disguise. Again, the nature of the order is such that the CBN would need to take positive action to make the extension of the deadline reasonable. What is the value of extending the deadline if the Central Bank does not take positive action to put out more cash to ensure that the extension works? If the CBN does not challenge the order but does not take any of the necessary action that will alleviate the cash crunch how will the order be effective? This calls for realism that would have led to restraint.

The Supreme Court has the powers to make multiple directions to either the regulatory agency (CBN) or the lower court to more intelligently and transparently manage the issue. It is part of the responsibility of the Supreme Court as a policy court to make such direction where the agency or institution that has statutory responsibility needs to be more objective or transparent in executing its responsibilities. The power of the Supreme Court does not require it to take over technical decision-making from the designated decision-maker, especially when the subject matter is one that requires insulation from politics and is not judicially manageable. This is the basis of the principle of judicial deference to the expertise of regulatory institutions as espoused by the US Supreme Court in Chevron v. Natural Resources Defense Council 467 U.S. 837 (1984).

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.