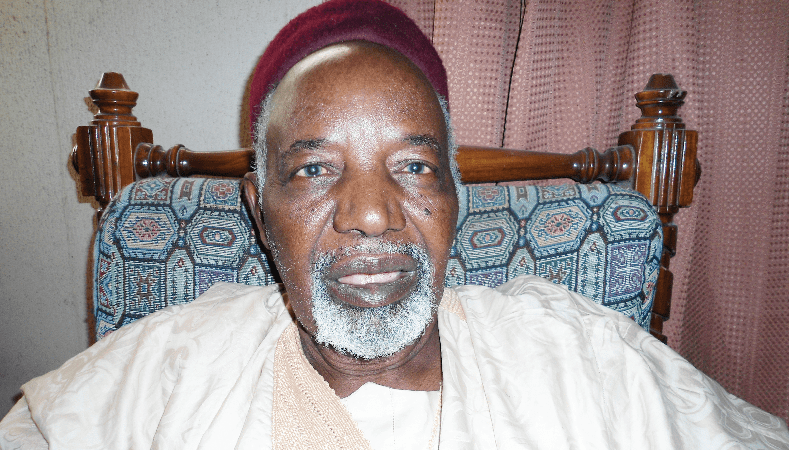

Oseni Elamah, executive secretary of the joint tax board (JTB), says the taxpayers in other parts of the country are not up to 50% of those in Lagos.

Elamah, who made this statement while speaking in Abuja, said state governments would benefit greatly from the implementation of Voluntary Assets and Income Declaration Scheme (VAIDS).

VAIDS is an initiative of the ministry of finance. It is aimed at getting individuals and corporate bodies to voluntarily declare their income and assets as a basis for tax assessment.

He said the drop in oil prices made it necessary for the government to pay attention to taxes, “a more reliable way of generating revenue”.

Advertisement

“Whatever taxes that have not been paid previously on assets and income are assessed and paid in order to avoid legal actions and then penalties and interest will also be waived,” he said.

“The taxable entities or individuals reside in states and the tax authorities have the responsibility to subject them to tax payment.”

According to Elamah, the JTB would coordinate the collaboration between tax agencies to ensure successful implementation of VAIDS.

Advertisement

“We have information on Nigerians who have acquired a lot of assets and incomes that are not known to the tax authorities,” he said.

“This window provides an opportunity for us to have an exchange of information. Based on the information, the data will be used to assess both corporate and individuals.

“Data mining is extremely important. States in Nigeria have different levels of development. So, while it is easy for Lagos, Rivers or Kano to collect data, it is not same for some other states.”

He said tax enlightenment would make the job easier for states.

Advertisement

“If every state can replicate that, it will help in mining information. In Lagos for instance, it is not only for collecting taxes, it is also to meet the stakeholders in their various locations to obtain data and information.

“These data were fed back into the system and this gave Lagos huge number of taxpayers. The number of taxpayers in the whole of the country is not up to 50% of what you have in Lagos.

“So, we have to do a lot of work and that is the reason we are trying as much as possible to carry every of the state revenue authority along and give them the necessary tools and assistance to sensitize their people and be able to collect this data.”

He advised individuals and corporate entities with undeclared assets and income to take advantage of the window offered by VAIDS.

Advertisement

Add a comment