On Sunday, the International Monetary Fund (IMF) announced immediate debt relief for 25 countries — 19 of them in Africa. Nigeria was not on that list because the west African giant does not owe the Bretton Woods institution. On April 2, 2020 the World Bank had also announced the first set of COVID-19 emergency support worth $1.9 billion for 25 countries — excluding Nigeria. According to the international lender, the funds were for the “poorest and most vulnerable countries”.

Ngozi Okonjo-Iweala, the former managing director of the World Bank, has been at the forefront of requesting debt relief for African countries, including asking for a $44 billion forgiveness from the G20 only last week. But Nigeria may not benefit as much as needed from that intervention because, despite having the largest number of people living in extreme poverty, it is considered by the World Bank as a lower middle-income country and not a low-income country.

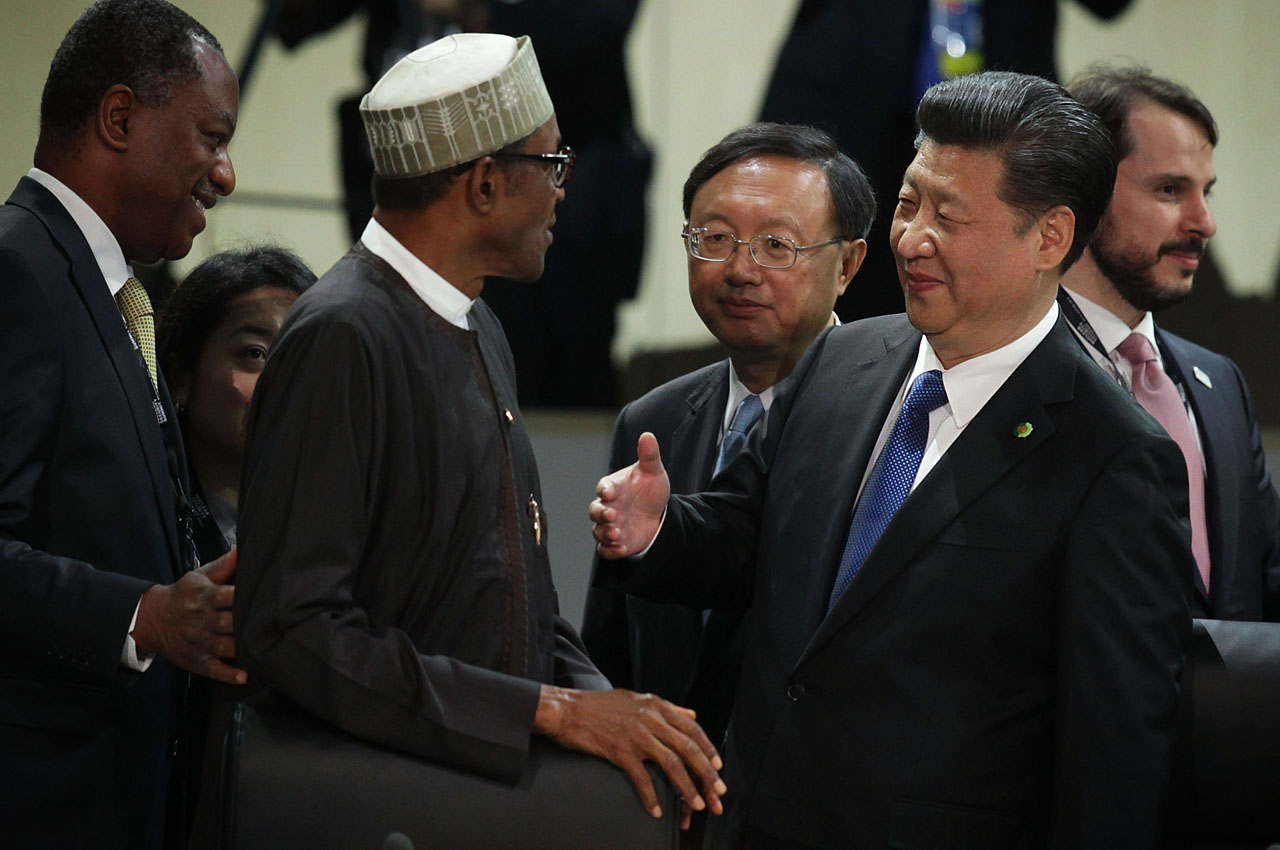

Nigeria needs to look elsewhere, and this time — to China.

According to data from the Debt Management Office (DMO), China is Nigeria’s biggest bilateral lender, and a huge part of its debt servicing goes to the Asian country, where the novel coronavirus broke out in December 2019.

Advertisement

In 2019, Nigeria paid $138.8 million (N53.7 billion) to the EXIM Bank of China in debt servicing and settlement — the highest amount paid to any bilateral institution for the year.

As far as bilateral debts go, Nigeria is indebted to China, France, Japan, and India. But over 80 percent of that debt is owed to China alone. In summary, Nigeria owes China $3.2 billion (N1.2 trillion) — and the remaining three countries a mere $672 million combined.

Many countries across Africa are also heavily indebted to China — especially Kenya and Ethiopia — and may find it very hard to service their debts in the face of the economic realities imposed by the novel coronavirus, which is ready to set the world back by some $1 trillion, according to the UN.

Advertisement

Cyril Ramaphosa, the chairperson of the African Union and president of the Republic of South Africa, recently appointed Okonjo-Iweala, Donald Kaberuka, Tidjane Thiam and Trevor Manuel as special envoys of the African Union to seek economic help — including debt relief — from the European Union and the G20, which includes China.

Debt-relief or cancellation will cost China, the top bilateral lender to Africa, a whole lot of money across a continent it has heavily invested for over 20 years. But desperate times require desperate measures — and there are no worse desperate times in the 21st century than now.

The IMF predicted on Tuesday that Nigeria will slip into its biggest economic recession in 33 years. Gita Gopinath, IMF chief economist, also stated that both advanced economies and developing countries will slide into a recession for the first time since the great depression.

An official at the Chinese foreign ministry told Reuters this week that “the origin of Africa’s debt problem is complex” but the country is “willing to study the possibility of it jointly with the international community”. News from the G20 suggests that the financial leaders in those leading economies are looking to grant a debt freeze of six to nine months from next week. But Nigeria needs more than a freeze.

Advertisement

To better prepare for the coming recession — projected to be the worst in about 33 years — Nigeria would need all the economic help it can get. TheCable is campaigning for interest rate waiver for at least 12 to 24 months — or as long as Nigeria is in recession. This will be in addition to a valuable debt reduction.

A recession in the world’s poverty capital will have very painful consequences for over 350 million people in western Africa and the rest of the African region. If China really cares about Africa, now will be the time to show it.

Add a comment