As the G20 Summit in China concludes, which represented a first for hosts China, and also the first gathering of world leaders after the EU referendum outcome in June and before the Presidential Election in the United States this November, let’s take a brief look at the main talking points with notable attention surrounding UK Prime Minister Theresa May who was participating in her first visit to China as Prime Minister of the United Kingdom, following former Prime Minister David Cameron stepping down in the aftermath of the EU vote.

Premier XI Jinping takes centre stage

It goes without saying that for China to be in a position to host a world-renowned G20 Summit that this underlines how far China has established itself as a leader in the world economy. In just under one year, China has not only hosted an historic G20 Summit, but has also seen its currency added into the prestigious Special Drawing Rights basket from the IMF. As far as the G20 Summit goes, Premier XI Jinping took full centre stage and hosted the festivities while Barack Obama seemed to be getting ready to fade into the background as he gears up for his final months as President of the United States before stepping down in November.

One key takeaway from one of Premier Xi’s opening speeches was how the China President urged leaders to avoid “empty talk” when attempting to improve global economic momentum. While so much pressure is generally placed on the shoulders of central banks to improve economic momentum, we have approached the limit by many accounts when it comes to how far a central bank can possibly move in terms of monetary policy. What Premier XI seemed to be hinting at with these comments, and this is also something that ECB President Mario Draghi has been repeating for years is that the global economy needs fiscal reforms. There is only so much a central bank can do when it comes to easing their monetary outlook, but governments can introduce fiscal reforms that improve spending and are not just aimed at austerity and the only way to achieve this is for world leaders to come together and support one another at a time when the global economy is still facing many challenges, with just one of these challenges being slowing global trade.

Advertisement

Both China and the US commit against currency devaluations

Another talking point as the G20 Summit concludes surrounds the reports over the weekend on Sunday that both China and the United States committed to refrain from competitive currency devaluations, where both the USD and more recently the RMB has been criticised in the past for devaluations. Both China and the United States agreed that they would “refrain from competitive devaluations and not target direct exchange rates.” What this means moving forward is that we can expect some stability in the Yuan in the months ahead as China readies for the Yuan to be officially introduced into the Special Drawing Rights (SDR) basket by the IMF on October 1. Over the next couple of weeks, it would not surprise me if policymakers out of China and even the People’s Bank of China (PBoC) themselves suggest that their future outlook for the RMB is stability and that economic data in China is finding a level of consistency which should also dispel ongoing worries about their own GDP downturn.

How was Theresa May’s visit to China perceived?

Advertisement

In her first visit to China as Prime Minister of the UK, Theresa May expressed confidence in the overall strength of the UK economy and appeared optimistic towards the nation’s ability to reinforce its position as a great trading nation despite any negative ramifications to the EU Referendum outcome. With recent data from the UK displaying signs of economic recovery post-Brexit there seems to be optimism emerging that the EU referendum vote will not have an immediate negative impact on the UK economy and this might help her negotiation power.

Although there are ongoing concerns over the UK’s ability to secure trade deals following the EU referendum outcome, the indications of bilateral meetings taking place with other nations at the G20 have signalled a sense of determination from the UK to create and strengthen trade with other major economies around the world. With South Korea, Mexico and India all expressing their willingness in co-operate and remove barriers that could be preventing trade, the UK appears to be having no problems sourcing news trade agreements following the encouraging reports with Australia a few weeks back.

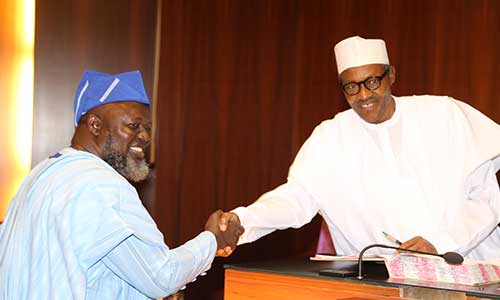

Another key takeaway point from the G20 meeting is that Britain appears committed to achieving a global strategic partnership with Beijing which could help the nation weather any potential post-Brexit shocks in the period ahead, while also showing that Theresa May is interested in establishing a similar relationship with Premier XI Jinping as Former Prime Minister David Cameron appeared to have developed before stepping away from his position.

But was it all positive for Theresa May?

Advertisement

While the new UK Prime Minister might be leaving China with positive headlines following indications of further talks to strengthen trade with Australia, while also developing discussions with the likes of India and Singapore it would be an understatement to suggest that it will be plain sailing for Prime Minister May. Although US President Barack Obama did not repeat his previous claim from this Spring that the UK risks falling to the back of the line in any trade deal with the United States if it votes to leave the European Union, it was made clear that the UK will not be receiving any preferential treatment from the United States.

Theresa May also received a stark warning from Japan when the Japanese government warned that it might move firms outside of the Britain if the UK loses its access to the EU single-market. This without a doubt represented the strongest condemnation on how the international community feels about the decision from the UK to vote towards leaving the EU.

IMF makes its presence felt

The International Monetary Fund (IMF) wasted no time in reminding members of the G20 that the first priority of the summit should be a coordinated effort to improving global growth. Concerns over slowing global growth have been a recurrent theme throughout 2016 and have also encouraged the IMF to downgrade their own forecasts with the most recent downgrade being just after the EU referendum. Central banks remain on standby with pressure ongoing to do more and they might have welcomed the news around G20 members agreeing to identify the reforms that could help achieve growth, which will provide optimism that governments might finally be in a position to work with each other in comparison with all the pressure being left at the feet of the central bank of that economy.

Advertisement

Another important talking point was the commitment that growth across the world economy should be equally spread out. The IMF urged nations to implement effective tools which could diminish excessive inequality while potentially raising economic prospects for the low income workers. Prolonged periods of low oil prices and uncertainty have sparked ongoing fears of slowing global growth with G20 members falling short of their 2014 promise to boost growth through increasing productivity. While the current outlook towards the global economy may seem uncertain, the future would be more positively enhanced if such summits could lead to G20 members working together to improve global trade.

Oil surprise by unexpected Russia and Saudi agreement

Advertisement

The price of oil received a temporary and welcome boost with WTI finding itself briefly back above $45 following an unexpected announced agreement between Saudi Arabia and Russia.

Both of these large producing oil nations have seemingly agreed to find ways to stabilize the oil market, but they stopped short of providing any impending clues that this might mean a change in production output and this quickly led to oil retracing its positive momentum. Russian President Vladimir Putin was also interviewed as encouraging oil producing nations to agree on a production freeze during the upcoming “informal” OPEC meeting later in September and this goes some way towards showing that Russia would benefit from a stronger price of oil and the comments from Putin might lead to other leaders at oil producing nations making similar public comments before the meeting takes place later in September.

Advertisement

Overall and when you consider that both Saudi Arabia and Russia two of the largest oil producers in the world, the prospects of these nations coming together to make some sort of agreement to find a way and stabilise the market might mean optimism increases over a more positive outcome to the upcoming OPEC meeting.

Follow Jameel on Twitter @Jameel_FXTM

Advertisement

Ahmad is VP of market research at FXTM