President Bola Tinubu, on Tuesday, directed the immediate implementation of recommendations of a report on the ‘quick-win achievements’ of the presidential fiscal policy and tax reform committee.

Ajuri Ngelale, the president’s special adviser on media and publicity, disclosed this to journalists after a meeting between the president and the committee at Aso Villa, Abuja.

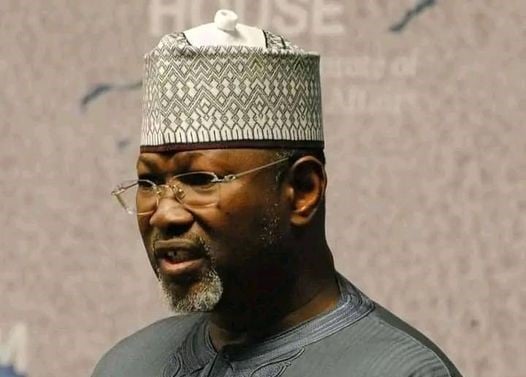

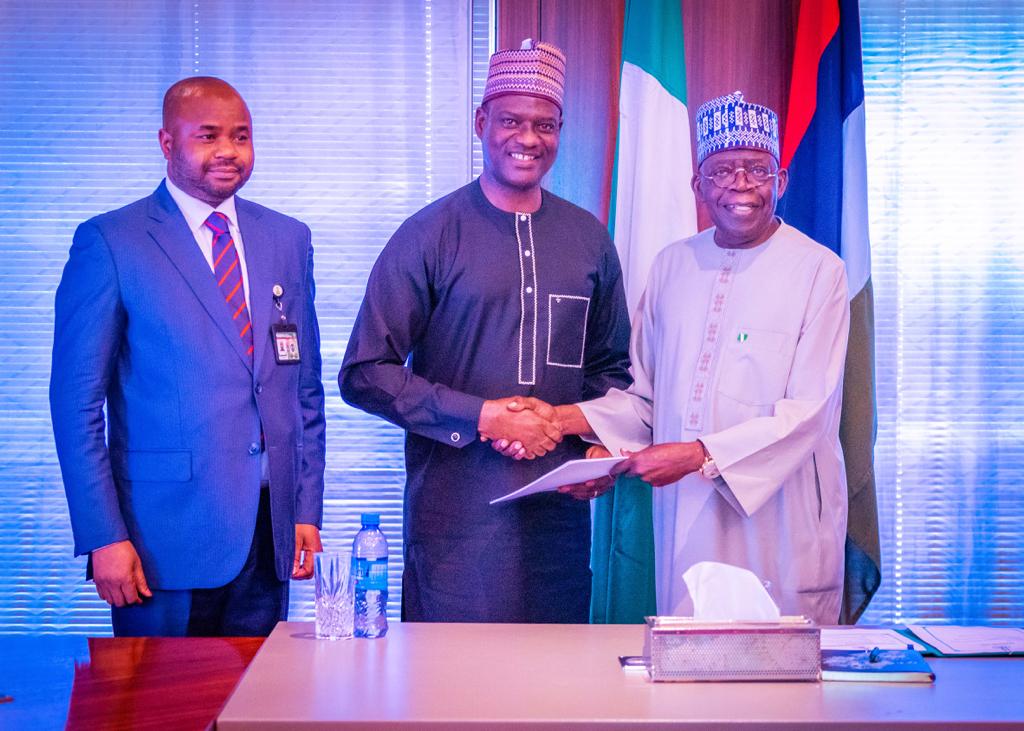

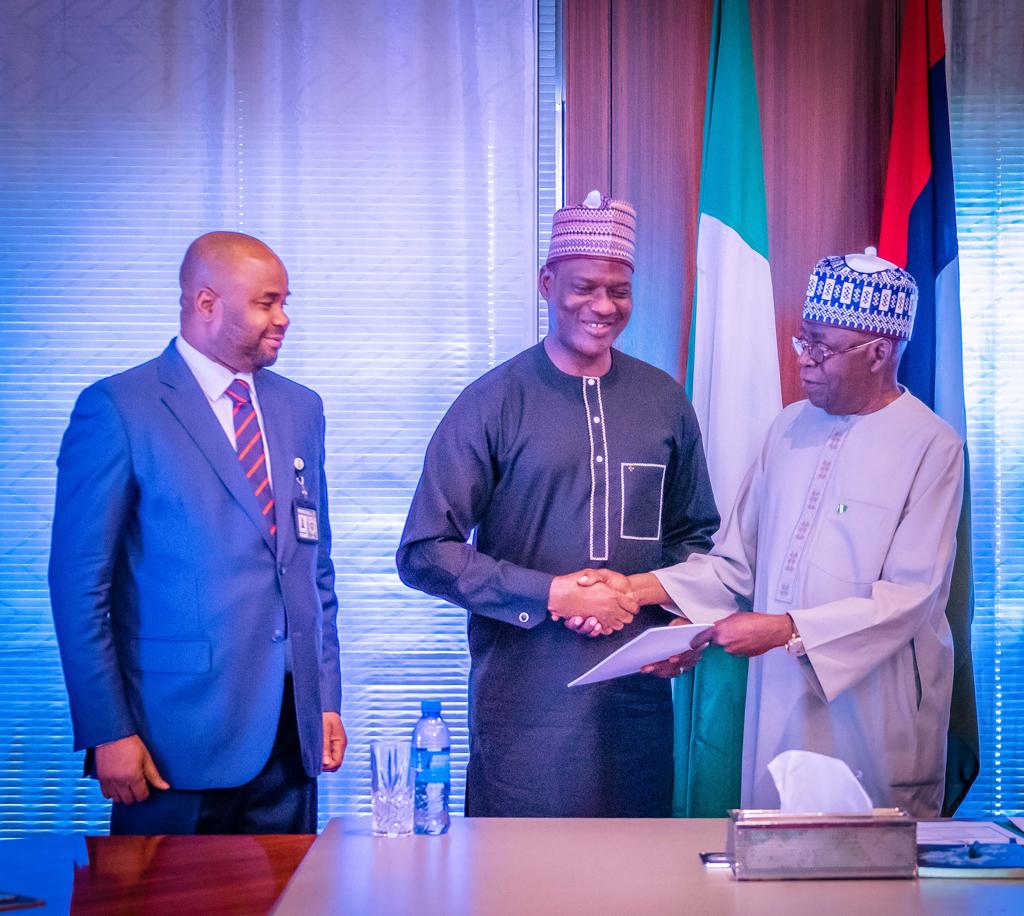

He said Tinubu gave the directive when Taiwo Oyedele, chairman of the committee, presented the report.

Ngelale said the president also directed George Akume, secretary to the government of the federation, to commence the implementation of all recommendations across ministries, agencies, and departments of the federal government.

Advertisement

The presidential special adviser said the purpose of elevating the proposals throughout government establishments is to “guarantee efficient coordination and integration during their execution”.

Although Ngelale did not mention what the policy suggestions are, he further disclosed that Tinubu promised to make the presentation of the recommendations a priority item when the federal executive council (FEC) meets again on Monday.

“After listening to a presentation by the committee chairman, the president directed the special adviser to the president on policy coordination, Hadiza Usman, to liaise with the SGF and the chairman of the tax policy review committee,” Ngelale said.

Advertisement

“This is to ensure that the recommendations of the committee are swiftly and immediately implemented across all ministries, departments, and agencies (MDAs) of the federal government to ensure that there is effective synergy

“And to ensure that every institution of the federal government is on the same page with respect to how tax policy will be implemented.

“Henceforth, His Excellency Mr President has also made available an opportunity for the recommendations of the tax policy review committee to be made a top priority at the next sitting of the FEC meeting on Monday.

“The president will continue to emphasise the importance of ensuring that our tax authorities are not taxing the seed, but are taxing the fruit and that will continue to be the focus.”

Advertisement

In August 2023, the tax reform committee was inaugurated.

The president had said the panel would be responsible for various aspects of tax law reforms, fiscal policy design and coordination, harmonisation of taxes, and revenue administration.

Speaking to reporters after submitting the report, Oyedele disclosed that the government’s target is to cut down the long list of officially collectable taxes and levies — which currently exceeds 60 — into a much more manageable single-digit number.

’NUMBER OF PAYABLE TAXES TO BE REDUCED TO 10’

Advertisement

Oyedele, who was accompanied by Zacch Adedeji, the chairman of the Federal Inland Revenue Service (FIRS), said the committee’s aim is to consolidate these taxes at all levels of government — reducing the total number to less than 10.

He said his team had started the process of revising the country’s tax laws as part of the process of birthing a standard and more effective tax administration.

Advertisement

This, the tax committee chair said, is in line with the panel’s core goals of reforming the tax policy of the country and reducing barriers against businesses in Nigeria.

Oyedele said the task of restructuring the tax system in the country will not be achieved through the courts, (citing the circumstances around the value-added tax (VAT)) but by assembling stakeholders for deliberations and approaching the national assembly.

Advertisement

The tax expert also noted that a mere 10 taxes account for nearly 96% of the total revenue collected by the federal, state, and local governments in Nigeria.

He said Nigeria is currently at a critical phase of revising its laws and regulations on taxation, adding that the committee had engaged with the senate and the house of representatives with the objective of addressing all necessary reforms.

Advertisement

The panel has also commenced public consultation and stakeholder engagement on tackling some of the controversies around the VAT law, insisting that solutions will only come from Nigerians and not from the law court, he said.

“So all we did today was to formally present the report to Mr. President, but I will say that once we get the nod from Mr. President, it will be like just switching on the tap and then the implementation starts immediately,” Oyedele said.

“There’s so much work for us to do, this is just Milestone #1, it is what we call the quick wins. The second phase, which is where we are now, is the critical reforms.

“Those critical reforms involves even rewriting our major tax laws, addressing something that everybody in this room will be very much familiar with; multiplicity of taxis.

“We have over 60 taxes and levies, officially collectible by federal government, state governments and local governments. Unofficially, those taxes are over 200, making life difficult for our people. So the objective we have, and that’s what we’re working towards, is to bring all of that to a single digit.

“So the taxes at all levels of government combined, we think should be less than 10 because actually about 96%, actually more than that, of our revenue across federal, states, local governments, currently is generated from less than 10 taxes and we’ve seen countries like South Africa generating more than our entire national tax revenue from just one tax.

“So there’s no evidence to show, in fact, the contrary is true that the more the number of taxes you have, actually the less revenue you collect because it just creates the opportunity for leakages and some non-state actors collecting money and keeping it to themselves.

“We were speaking to traders, MATAN (Market Traders Association of Nigeria) and they said to us, people selling pure water in the market collect seven tickets every single day. Why should someone who is just trying to hawk pure water to keep body and soul together have to pay seven taxes on a daily basis? It doesn’t make a lot of sense to us.

“So now we are at that phase of rewriting our laws. We spent time with the Senate and we would also do the same thing with the House of Assembly and the whole idea is we think that some of the reforms we need to introduce we have to go to the Constitution itself, lack of clarity about taxing rights between levels of government.

“We’re all familiar with the dispute around VAT (Value Added Tax). We think that the solution will not come from the courts, it will come from Nigerians coming together to say ‘actually, this is the best way to deal with these matters’.

“We have commenced our public consultation and stakeholder engagement, it’s opened until the 15th of November. I’m glad to inform you that after just a few days of opening up that platform for engagement, we have received inputs from every single state in Nigeria and we’re just starting”, he said.

Add a comment