In 2008, the world experienced an economic recession, which had devastating effect on millions.

One year after, the economy began to take shape, with that of Nigeria experiencing a steady gross domestic product (GDP) growth, which went as high as six percent in 2014.

But with low GDP forecast, controversial foreign exchange policy, subsidy weight and strange sanctions, it is glaring that the feat cannot be repeated in 2015.

Activities which took place in the business sector of the largest economy in Africa between October 26 and October 30 may lead to the conclusion that this is the worst week in Nigeria’s business history since 2008.

Advertisement

MTN GROUP VS NCC N1.04TR FINE

On Monday, the Nigerian Communications Commission (NCC) imposed a fine of N1.04tr on MTN Nigeria, the largest telecommunication network in the country, for failure to disconnect 5.1 million unregistered SIM cards.

The sanction, which is the strictest in the history of the country’s telecom industry, is capable of scaring investors, considering the fact that the fine is more than MTN’s annual profit – even during its peak periods.

Advertisement

“It’s the last thing Nigeria needs, given the economic and political struggles it’s contending with at the moment. It’s concerning for MTN and in terms of the wider implications for foreign investment,” David McIlroy, chief investment officer at Alquity, said.

Though talks are ongoing between South African government and the NCC, the sanction is having effect on MTN as its stock is fast declining, losing over 19 percent of its share value on the Johannesburg Stock Exchange (JSE) in just three days.

LOSSES OF SHELL, OANDO AND JULIUS BERGER

Advertisement

With an exception of distressed banks, Oando recorded the largest loss by any company listed on the Nigerian stock exchange.

Result released at the close of business last week revealed that the oil firm lost N184 billion in the 2014 fiscal year.

The losing streak continued on Monday as the company’s first half loss stood at N35 billion and its Q3 results revealed a N127 billion ($63.5m) loss after tax.

On Wednesday, Royal Dutch Shell, which has massive business interest in Nigeria, posted a N1.48tr ($7.4b) loss for Q3.

Advertisement

Wale Tinubu, chief executive officer of Oando, blieves that apart from the dwindling oil prices, the weakness of the naira also contributed to the loss.

In like manner, Julius Berger had 72.6 percent decline in profit, with Total (Oil) losing 19.47 percent in the same quarter.

Advertisement

FEDERAL REVENUE, FOREIGN RESERVES HIT RECORD LOW

Speaking of naira weakness, Nigeria’s revenue generation, this week, fell to a record low since President Muhammadu Buhari took over power at the federal level.

Advertisement

The allocations shared by the three tier of government fell from N409 billion in June, N412 billion in September to N398 billion in October as revenues continued on a nosedive.

About the same time in October 2014, the tiers of government shared N593.3 billion made up of statutory revenue of N484.32 billion, N35.55 billion Subsidy Reinvestment and Empowerment Programme (SURE-P) funds and N6.33 billion refunded by the Nigerian National Petroleum Corporation (NNPC).

Advertisement

This brutal week did not spare the foreign reserves, as they also fell to a three-month-low, hitting $30.13 billion on Tuesday, leading the CBN to weaken the naira on the interbank market.

TSA FINE ON UBA AND FIRST BANK

It wasn’t also a good week for United Bank for Africa (UBA) and First Bank Nigeria Limited – two giant commercial banks in the Nigerian commercial space – as a fine of N4.8 billion fine was slammed on both financial institutions for breaching the treasury single account policy of the current administration.

While First bank has confirmed payment of N1.8 billion, its own share of the fine, it is unclear if UBA had fulfilled its own obligation as at the close of business for the week.

STANBIC IBTC VS FRC

On Monday, the Financial Reporting Council (FRC) suspended four directors of Stanbic IBTC, with a request that the CBN and the Economic and Financial Crime Commission (EFCC) investigate the bank and KPMG for “financial misstatements”.

The four directors suspended are Atedo Peterside, Sola David-Borha (pictured below), Arthur Oginga and Dare Owei.

The bank responded by criticising the council for making “inaccurate and unfortunate” allegations and breaching the procedural guidelines laid down in the law.

The allegations were not without its consequences as Stanbic’s share price fell by 17 percent just after the sanctions were handed down, closing at N19.20 on Wednesday.

The bank also posted a Q3 result, with a 46.31 percent decline in profit.

INFLATION, NAIRA DEVALUTION AND THE MANY DEBATES

Respite not in sight as business leaders remain divided over Nigeria’s policy direction.

Five months after the new government took power, inflation has risen month-on-month by at least 0.1 percent, hitting an-eleven-month-high in October at 9.4 percent.

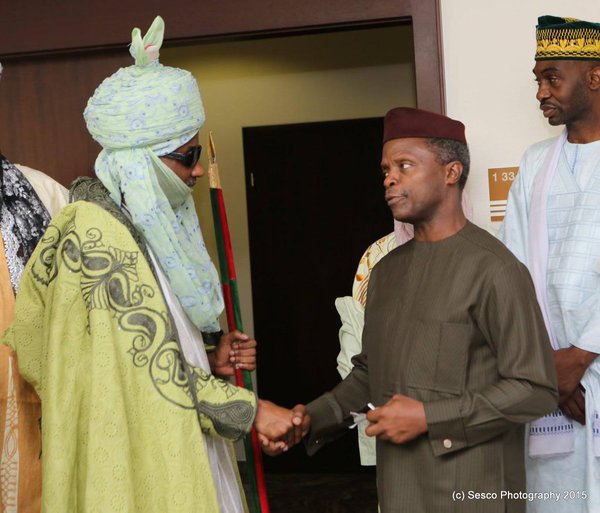

Muhammad Sanusi II, emir of Kano and former governor of the CBN, wants the government to end subsidy and review its foreign exchange policy.

“The president needs help on the economy and it is extremely important to understand that even if you have security, even if you fight corruption, you still need to have jobs, power, you still need to build agriculture, attract investments and that cannot be done if we continue dismissing the view of investors and foreigners who want to bring money into this country,” he said at a programme in Lagos, last week.

Vice-President Yemi Osinbajo, who is head of the Buhari’s economic team, has reiterated the country’s stance on the economy, saying there will not be further devaluation of the naira.

DAYS AHEAD

In the course of the week, Bismarck Rewane, CEO of Financial Derivatives, said “the naira is only misaligned temporarily”, suggesting that the current policy will have positive effect on the economy in the long run.

Osinbajo’s thoughts are in like manner, insisting that the government is adequately preparing for the 2016 recession forecast but Sanusi begs to differ, certainly the days ahead would be the judge.

Nigerians can only pray that the drivers of the economy are right with their economic policies, else, October 2015 would end up not being the worst economic month in the Buhari-led government.

Add a comment