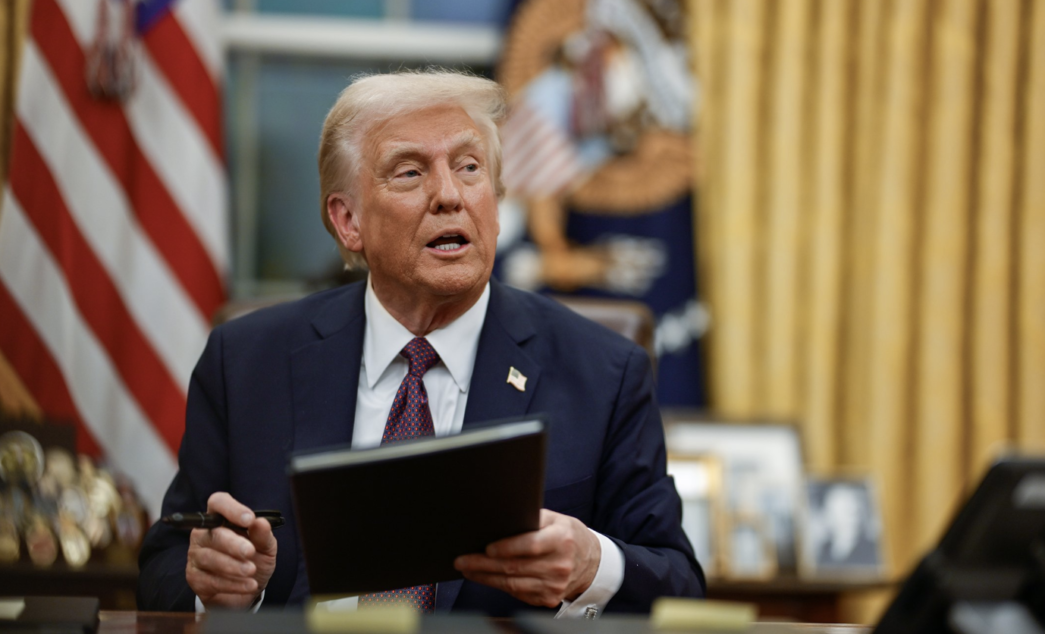

Donald Trump

BY AYOTUNDE ABIODUN

US President Donald Trump’s executive order relaxing the enforcement of the Foreign Corrupt Practices Act (FCPA) is expected to have significant repercussions beyond US borders, particularly in countries like Nigeria, where corruption is a major issue. The FCPA has historically deterred corporate misconduct, requiring American companies to adhere to strict anti-bribery laws when operating abroad.

By easing the enforcement of this law, the US may inadvertently encourage corrupt practices among foreign and domestic actors in Nigeria. This shift in policy may undermine efforts to promote ethical business practices and prevent illicit financial flows, which could have far-reaching consequences for developing economies that rely on the FCPA to help combat corruption.

A key concern is a potential rise in corporate bribery, particularly in Nigeria’s extractive industries, where US firms are prominent. The FCPA previously limited illicit deals, compelling compliance. Relaxed enforcement may embolden US corporations to bribe for contracts in sectors like oil and gas, telecoms, and infrastructure, where such payments often influence outcomes. This could worsen corruption, hindering Nigerian agencies like the EFCC and ICPC.

Advertisement

Beyond immediate economic implications, the rollback of FCPA enforcement threatens to erode Nigeria’s ongoing anti-corruption reforms. Over the past decade, successive Nigerian administrations have introduced policies to reduce corporate malfeasance, often in response to international pressure. Laws such as the Proceeds of Crime Act, signed into law by President Muhammadu Buhari in May 2022, and the Nigerian Anti-Corruption Strategy (NACS) 2022-2026 were developed with the expectation that global enforcement mechanisms like the FCPA would reinforce local efforts.

Now, with the U.S. effectively withdrawing from its role as a worldwide anti-corruption enforcer, there is less incentive for Nigeria’s political elite to sustain these reforms. Without fear of US legal action, multinationals operating in Nigeria may increasingly use bribery, reversing progress in transparency and governance.

Relaxed FCPA enforcement creates an uneven playing field. Ethical US firms operating in Nigeria may be disadvantaged against those willing to engage in bribery. Previously, the FCPA ensured consistent anti-bribery standards. Compliant companies may struggle to compete, potentially deterring future investment from firms valuing governance and transparency and entrenching corruption. Despite the US rollback, international anti-corruption frameworks remain.

Advertisement

US companies in Nigeria could still face prosecution under acts like the UK Bribery Act and France’s Sapin II. Nigeria has also prosecuted multinationals for corruption, as seen in the Malabu oil scandal. US firms exploiting the FCPA rollback may still face legal action, reputational damage, and strained relations. However, there are concerns about the feasibility of this considering that the U.S. wields immense influence.

Anti-corruption enforcement has become a global effort, meaning even American firms can be forced to play by the rules. That said, Trump is rewriting the rules. His administration has taken a more protectionist stance, prioritising U.S. corporate interests over global accountability. This shift has the tendency to weaken international anti-corruption enforcement if other global powers do not resist. Power may tilt the playing field, but it does not guarantee impunity.

On a broader scale, Trump’s decision undermines U.S.-Nigeria relations, particularly in governance and anti-corruption cooperation. Over the years, the U.S. has worked closely with Nigeria to recover stolen assets, strengthen institutional oversight, and promote transparency in public and private sector dealings. Weakening the FCPA sends a contradictory message—on the one hand, the U.S. encourages Nigeria to fight corruption, while on the other, it signals that American businesses no longer need to play by those same rules. Nigerian civil society groups, which have relied on global advocacy to hold corrupt officials accountable, may view this as an abandonment of ethical leadership, potentially weakening Nigeria’s resolve in tackling corporate corruption.

Perhaps the most concerning implication is the impact on Nigeria’s investment climate. Corruption remains one of the biggest deterrents to foreign direct investment, as it increases operational costs and creates an unpredictable business environment. If Nigeria becomes more deeply associated with corporate bribery due to the FCPA rollback, foreign investors—particularly those from regions with stringent compliance requirements—may hesitate to enter the market. This could be especially damaging to sectors like technology and renewable energy, where Nigeria is looking to attract long-term investment. Moreover, Nigerian businesses establishing international partnerships based on ethical standards may be sidelined if corruption becomes the norm.

Advertisement

Ultimately, while the FCPA rollback may offer US companies short-term relief, it poses serious long-term risks for Nigeria. It could potentially deepen corruption, weaken governance, and damage investor confidence. It also raises questions about how Nigeria can sustain anti-corruption efforts without external enforcement. Nigeria must strengthen its domestic frameworks to prioritise corporate accountability, regardless of US policy shifts, or risk further entrenching bribery and unethical practices, with dire consequences for development and governance.

Abiodun is an analyst at SBM Intelligence

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment