Union Bank says it has received a $40 million finance guarantee facility from the International Finance Corporation (IFC) to boost access to finance for local businesses.

In a statement on Friday, the bank said the facility was approved under the IFC’s global trade finance program (GTFP) and would help to enable increased international trade for Nigeria and help protect the country’s economy from the impact of the COVID-19 pandemic.

It said the facility will help establish working partnerships with nearly 300 major international banks within the GTFP network, thereby broadening access to finance and reducing cash collateral requirements for Nigerian businesses.

Union Bank also explained that the facility will enable the continued flow of trade credit into the Nigerian market at a time when imports are critical, and the country’s exports can generate a much needed foreign exchange.

Advertisement

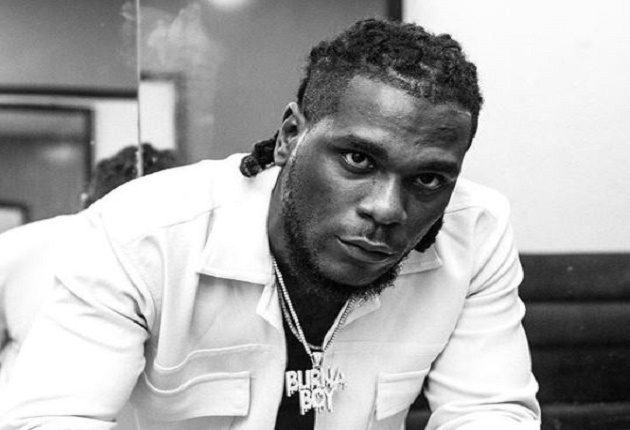

Commenting on the development, Emeka Emuwa, chief executive officer of Union Bank, said: “Union Bank is pleased to join the IFC’s global trade finance program (GTFP). This is a significant achievement as we continue to expand our trade financing offerings to our corporate customers”.

“Even in these peculiar times, we remain focused on contributing to economic growth by developing tailored solutions that help our customers to harness the teeming opportunities that still exist in the Nigerian market.”

Eme Essien Lore, IFC’s country manager for Nigeria, said: “Keeping trade moving is essential to growth and job creation, especially during the challenging economic times we are living through today.

Advertisement

“We welcome Union Bank to IFC’s global trade finance program and value a partnership that will make a positive impact on Nigeria’s economy”.

IFC said the partnership reflects its growing commitment to Nigeria, with investments focused on sectors including healthcare, agribusiness, manufacturing, technology, and small and medium enterprises (SME) financing.

Add a comment