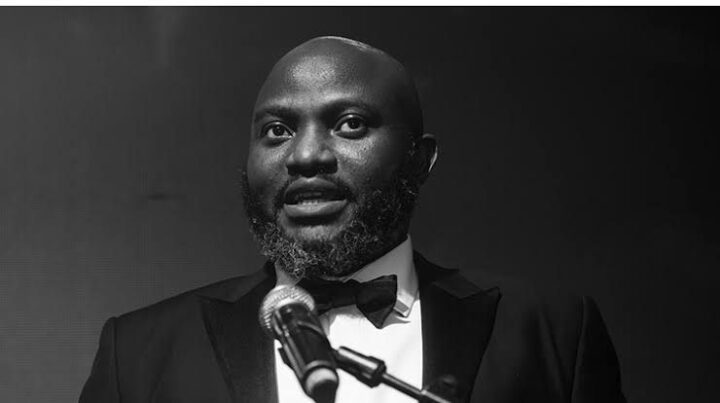

Dozy Mmobuosi, former co-chief executive officer of Tingo Group

The United States Securities and Exchange Commission (SEC) has made charges against Mmobuosi Banye, also known as Dozy Mmobuosi, chief executive officer (CEO) of Tingo Group, for multimillion-dollar fraud.

The development is coming one month after Tingo, an agri-fintech company, was suspended from the US stock market for allegedly providing “inadequate and inaccurate information about its assets”.

In a corporate filing dated December 18, 2023, the SEC called for emergency relief to prevent Mmobuosi (the defendant) from the continued dissemination of “false information to investors and to protect corporate and investor assets”.

The US SEC said Mmobuosi lied about owning $461.7 million when he only has less than $50 in all accounts.

Advertisement

The firm also said the Tingo CEO has been lying to auditors, insider trading, and failing to file ‘Forms 4’ disclosing the sales of millions of agri-fintech common stock for which he was the ultimate benefit.

“The SEC’s complaint, filed on December 18, 2023, alleges that, since at least 2019, Mmobuosi spearheaded a scheme to fabricate financial statements and other documents of the three entities and their Nigerian operating subsidiaries, Tingo Mobile Limited and Tingo Foods PLC,” the statement reads.

“The complaint further alleges that Mmobuosi made and caused the entities to make material misrepresentations about their business operations and financial success in press releases, periodic SEC filings, and other public statements.

Advertisement

“For instance, Tingo Group’s fiscal year 2022 Form 10-K filed in March 2023 reported a cash and cash equivalent balance of $461.7 million in its subsidiary Tingo Mobile’s Nigerian bank accounts.

“In reality, those same bank accounts allegedly had a combined balance of less than $50 as of the end of fiscal year 2022.

“The complaint alleges that Mmobuosi and the entities he controls have fraudulently obtained hundreds of millions in money or property through these schemes and that Mmobuosi has siphoned off funds for his benefit, including purchases of luxury cars and travel on private jets, as well as an unsuccessful attempt to acquire an English Football Club Premier League team, among other things.

As part of SEC’s emergency application, the firm sought an order to temporarily freeze Mmobuosi’s assets; prohibit TIH, Agri-Fintech and Tingo Group from transferring money or property or issuing shares to Mmobuosi; enjoin the defendants from selling or otherwise disposing of their respective holding in Agri-Fintech and/or Tingo Group stock.

Advertisement

The firm also asked that Mmobuosi be prohibited from destroying, altering, or concealing records and documents.

Add a comment