The federal government has said it will seize properties that are built and owned by corporate organisations from where taxes are not being paid.

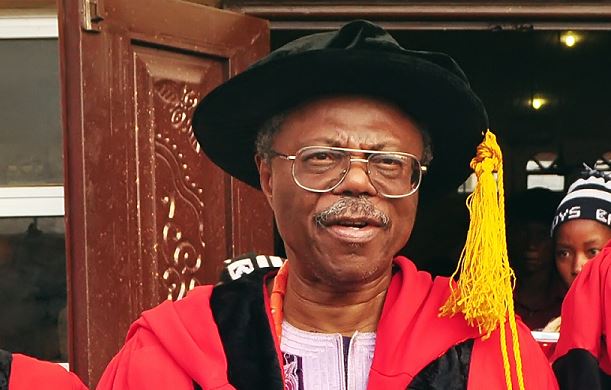

Babatunde Fowler, chairman of the Federal Inland Revenue Service, said this on Thursday during a media workshop on voluntary assets and income declaration scheme (VAIDS).

While urging individuals and companies yet to declare their earnings and pay relevant taxes to do so, Fowler said the government is set to move against tax defaulters upon the expiration of the amnesty period.

“There are over 2,000 properties in Abuja whose tax records are yet to be filed. We will be going to court to seize those properties and will be seeking to sell them off so as to settle the tax that should accrue from them,” he said

Advertisement

“If there is balance left, we would give that to the owners as what belongs to them.

“Regardless of the government that you have; the government that has a vision and has the best interest of you and I in heart; without funding, that vision remains the same.

“If we expect consistent economic development, you have to always pay your tax. Till date, nobody has been jailed for tax evasion, so this is a grace period. And I think people are beginning to see the level of seriousness on the side of government on the issue of payment of tax.”

Advertisement

Fowler said the federal government has realised N17 billion from some companies since the VAIDS started in July.

“Another N6 billion is expected to be paid before the end of December,” he said.

“We also have many companies and individuals that have already come forward, asking questions on how they can key into the scheme.

“All this will help improve the low tax-ratio from six per cent to 15 per cent by 2020 and curb the use of tax havens for illicit fund flow and tax avoidance.”

Advertisement

VAIDS offers a grace period from July 1 to March 31, 2018, for tax evaders to voluntarily pay back to the government what they owe.

Add a comment