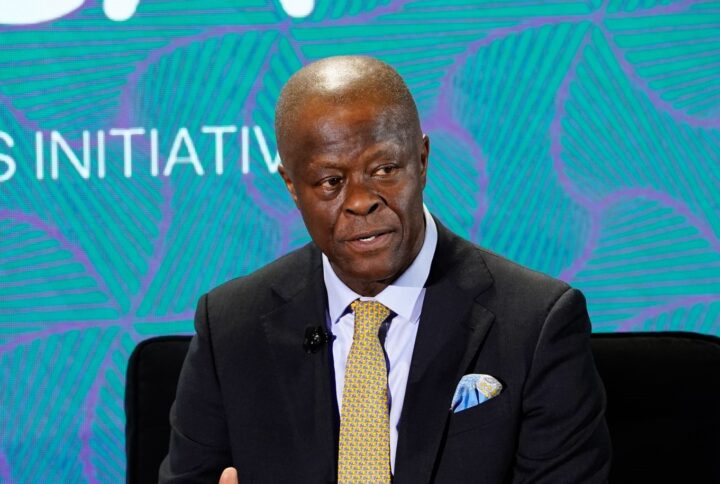

Wale Edun, finance minister and coordinating minister of the economy, says Nigeria’s tax-to-gross domestic product (GDP) ratio is low because citizens are not paying their taxes.

Edun spoke at an investors’ forum hosted by the Debt Management Office (DMO) on the sidelines of the ongoing International Monetary Fund (IMF) and World Bank annual meetings in Washington DC.

The flurry of reforms that has dotted the incumbent administration — especially on the monetary side — also stretched to fiscal matters of the government.

Advertisement

The federal government had, on October 25, 2023, received 20 policy reform recommendations from its tax committee billed for quick implementation.

The panel was created in July 2023 — two months after President Bola Tinubu took over — to harmonise taxes and coordinate revenue collection.

Although 50 percent of revenue generated by government-owned enterprises and ministries, department and agencies (MDAs) is already being deducted automatically, Nigeria’s tax authority is pushing for a single-window revenue collection system to “cut leakages”.

Advertisement

It is the hope of the government that the reforms would significantly increase Nigeria’s revenue, and most importantly, help Tinubu achieve his $1 trillion economy dream.

But speaking at the forum, Edun said at 10 percent, the contribution of tax to the country’s GDP is still low.

“The starting point really is that 10% to GDP, you can see that… should I say it?… people are not paying their taxes? So, there really is a lot of room without actually hiking tax rates,” the minister said.

“As I explained before, it is digitisation, and application of technologies that will take us there more than before. For instance, using an efficient process for assessing, for billing, for collection for monitoring what comes in.

Advertisement

“So, we are comfortable that we will be able to, over the next three, four years, double tax revenue as a percentage of GDP. It’s is very low, where it is now even by our African peers.”

Edun said the 2024 budget “has a significant 60/70% increase” in overall government revenue projected because Nigeria needs to borrow less and focus more on domestic resource mobilisation from taxes from other government revenue – including oil.

The economist said taxation without necessarily increasing the rate of taxes but improving the efficiency of administration and collection is the way to go to shore up government revenue in a non-inflationary.

‘AN EFFICIENT TAX SYSTEM NEEDED’

Advertisement

However, the first job is to put in place an efficient system, the minister said.

“Let me give you an example: throughout Nigeria, there are about 80-something taxes that people will bring you assessments at the local governments and the state level, even agency level,” he said.

Advertisement

“They will bring you all kinds of bills and invoices. And the analysis we have done shows that there are nine major tax revenue heads, withholding tax, and of course, income tax, and so on and so forth, that produce 90 percent of your revenue.

“So, if we can do away with some of these taxes, you wouldn’t lose much. And then you would pay in terms of people’s willingness to pay.”

Advertisement

According to the minister, if taxpayers are given an efficient system, and are billed properly, “that does help with the ability to collect taxes”.

Advertisement

Add a comment