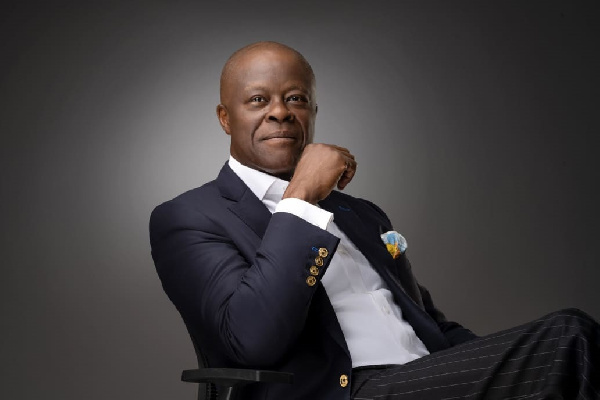

Wale Edun, minister of finance and coordinating minister of the economy, says the federal government will intensify efforts to tackle the problem of hyperinflation in the economy.

Speaking at a two-day retreat of the presidential committee on fiscal policy and tax reforms in Abuja on Thursday, Edun assured Nigerians that better days are ahead with the implementation of the ‘renewed hope’ agenda of President Bola Tinubu.

On August 15, Nigeria’s inflation rose to 24.08 percent — the highest in more than a decade.

Commenting on the surge, Edun said the removal of petrol subsidy had slowed down the economy, but said there were interventions in place to cushion the pains of the reform and plug leakages on subsidy management.

Advertisement

“It is the wish of Mr. President to create jobs, reduce poverty, control micro and macroeconomic policies to create a stable environment to attract investors, stabilise the exchange rate and drive the economy to reduce poverty to the lowest level,” the minister was quoted as saying in a statement signed by Stephen Kilebi, director of press at the ministry.

“The era of the nation’s gross domestic product (GDP) per capita falling by 30 percent over the past 10 years will be a thing of the past with Tinubu’s Renewed Hope Agenda.”

Edun reminded the committee members of the president’s 30-day deadline to deliver something tangible on their assignment, adding that the economy is not growing as fast as expected.

Advertisement

The minister advised the committee to fast-track its assignment, saying there is no time to waste.

On his part, Taiwo Oyedele, chairman of the committee, said the terms of reference of the panel include fiscal governance, revenue administration and tax policy review.

According to Oyedele, the deliverables from the committee include optimum taxes, harmonised revenue collection functions, a revised national tax policy, national fiscal framework.

He also said preparation of bills for a constitutional amendment, revenue optimisation, production of a model template for sub-nationals and establishment of the national tax amnesty scheme, were also to be looked into.

Advertisement

Add a comment