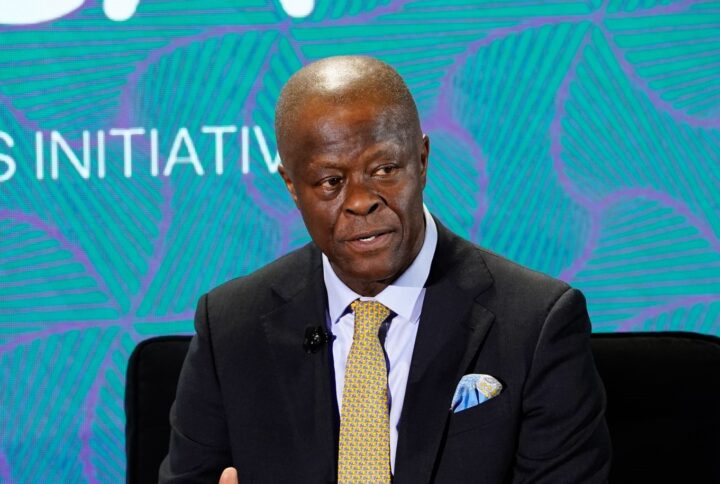

Wale Edun, minister of finance and coordinating minister of the economy said the current administration is looking into bringing down the ways and means debt.

The minister who spoke on Friday on Channels Television, said the move would be done through “specific actions that have been well laid out”.

Ways and means is a loan facility through which the Central Bank of Nigeria (CBN) provides short-term financing to cover the government’s budget shortfalls.

On February 9, 2024, while addressing the senate committee on banking, insurance and other finance institutions on inflation, Olayemi Cardoso, governor of CBN, said the financial institution will halt its ways and means advances to the federal government.

Advertisement

“The ways and means need to be brought down by specific actions and those are being taken in the financial markets and funds are being garnered, revenue is being raised with a particular intent to pay down the Ways and Means and have the government’s accounts imbalance,” Edun said.

“The government’s day-to-day accounts where it spends from and takes out revenue to have that imbalance, that is the commitment of the administration and the strategy and the path to achieving that in the nearest future. This has been well laid out.

“In addition, there is a need for collaborative collaboration between the monetary and the fiscal side. As we know, the central bank is in charge of the exchange rate, in charge of interest rates, money supply and so forth. And in terms of interest rate, the exchange rate it is doing everything it can to bring improvements to that situation.

Advertisement

“But the fiscal side, the government side has a role to play in that. And that is why taking a cue and collaborating and cooperating we want the monetary authorities to know what we’re doing. Interest rates have been raised.

“So the rate at which the government sells these treasury bills, and bonds has gone up in order to help attract foreign portfolio investors, foreigners who are willing to hold the naira and invest in the Nigerian economy by buying government securities.

“That is a sign of the type of collaboration and type of cooperation that will help the economy as a whole with the fiscal and the monetary side working together.”

‘OTHER REFORMS BY FG TO BOOST REVENUE’

Advertisement

Speaking on the measures put in place to boost revenue and control inflation, Edun said the federal government has identified the problem and was working rigorously to improve the economy.

He said the government has ensured oil revenue and production go up, adding that for the non-oil revenue sector, tax is being looked at to ensure it is less burdensome.

“In terms of inflation we have looked at the reason why you don’t build up money in the system not much by supplying productivity production to reverse and improve and eradicate that inflationary effects on the economy and the system as a whole,” he said

“The reforms that have been put in place include the fact that there needs to be removal of that overhang in the system. Therefore, in addition to a robust revenue system, we’re starting from ensuring oil revenue goes up.”

Advertisement

The minister said federal government-owned enterprises now have a much stricter regime of cost management because, through technology, the government is taking its revenue immediately rather than waiting for the enterprise to meet and comply with the rules.

“Rules are being enforced from the start by taking what is due to the government as soon as that revenue is paid,” Edun said.

Advertisement

“On the expenditure side, a totally new system of expenditure management has been authorised and approved by Mr. President, and has been implemented once again using the power of technology and digitalization.”

Edun said with this, the payments to suppliers, contractors, and beneficiaries will go directly to the federal treasury straight to the beneficiaries without having different places where it is redistributed.

Advertisement

Add a comment