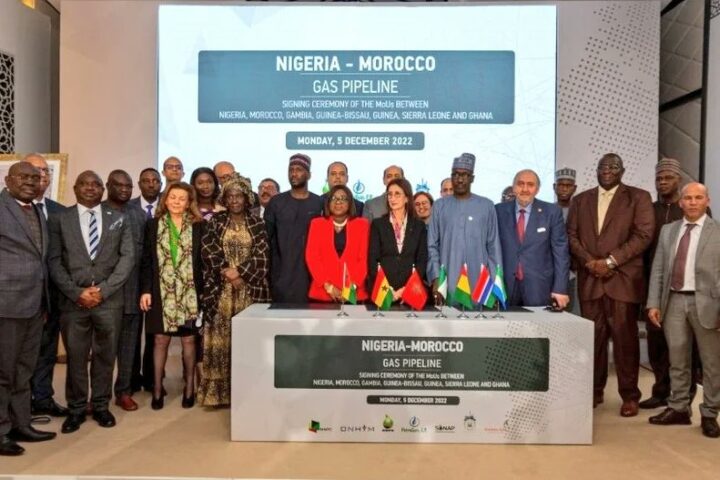

Patience Oniha, director-general (DG) of Debt Management Office (DMO).

The Debt Management Office (DMO) says it raised N130 billion from its N100 billion sovereign al ’Ijarah sukuk opened on November 21, 2022.

In a statement on Monday, DMO said the offer of N100 billion was “upsized to N130 billion due to the over 165 percent subscription level”.

The Sukuk is a strategic initiative that supports infrastructure development, promotes financial inclusion and deepens the domestic securities market.

Since the establishment of the initiative in September 2017, Nigeria has issued four sovereign sukuk: 2017 (N100 billion), 2018 (N100 billion), 2020 (N162.557 billion), and 2021 (N250 billion).

Advertisement

According to the statement, this year’s total sovereign sukuk issuance moved to N742.557 billion.

“The Debt Management Office (DMO) is pleased to inform the public of the successful conclusion of the issuance of N100 billion sovereign al ’ijarah sukuk. The offer for N100 billion opened on November 21, 2022, and was supported by wide public sensitisation to encourage subscription from diverse investors, particularly the retail investors,” the statement reads.

“The initial offer size of N100 billion was upsized to N130 billion due to the over 165 percent subscription level. The Sukuk was issued at a rental rate of 15.64 percent per annum. This brings the total sovereign sukuk issuance to N742.557 billion as at date.

Advertisement

“The level of subscription is evidence of investors’ confidence in the use and impact of sukuk in the construction and rehabilitation of road infrastructure across the country.”

Like the previous sukuk, DMO said proceeds of the 2022 sovereign sukuk will be used solely for the construction and rehabilitation of key road projects through the federal ministry of works and housing and the federal capital territory administration.

It also commended the strong participation of retail investors, ethical funds and non-interest financial institutions in the sukuk offering, adding that “this is government’s objective of promoting financial inclusion through admitting more retail investors and ethical funds into the financial system is being achieved”.

“The DMO on its part, will work to sustain the laudable achievements recorded so far in the use of sukuk-issue proceeds for the construction and rehabilitation of Nigerian roads, and thereby, continue to enhance [the] ease of commuting and doing business, safety on our roads, job creation, economic growth, and prosperity of our nation,” it added.

Advertisement

Add a comment