It is official, the UK economy has entered a recession for the first time in 11 years.

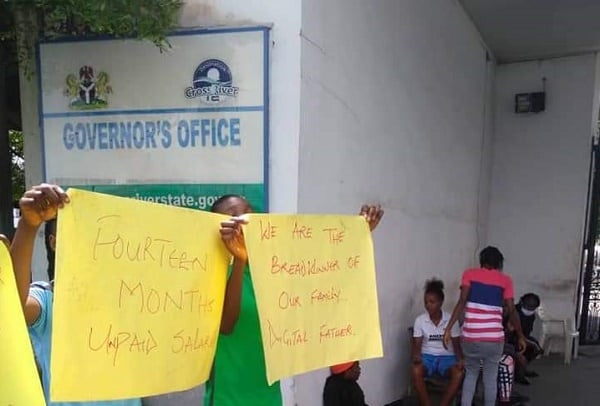

Economic growth during the second quarter was abysmal, plunging 20.4% after a 2.2% fall in the first three months of 2020. This was the largest recession on record and worst GDP seen in Western Europe. To rub salt into the wound, data released earlier in the week revealed an estimated one million jobs had already been erased during the coronavirus induced lockdown.

The current recession in the United Kingdom will certainly have negative impacts on bilateral trade between Nigeria and the United Kingdom. A possible spillover effect on Nigeria amid a reduction in trade and investment could enforce further pressure on the country which already entangled in a fierce battle against COVID-19.

As we move deeper into the third quarter of 2020, the outlook for Nigeria will remain influenced by not only the coronavirus developments but Oil prices and implementation of the revised 2020 budget of N10.81trillion.

Advertisement

Given how the economic calendar for Nigeria is void of Tier 1 economic releases this week, expect the Naira to be impacted by Dollar shortages and local stocks to remain influenced by domestic risks.

Commodity spotlight – Gold

It has been a wild week for Gold.

The precious metal experienced some hefty profit taking with prices plunging as low as $1863 yesterday before rebounding back above $1900. With US 10-year Treasury yield jumping the highest level since early July, this dented some of Gold’s allure.

Advertisement

However, the outlook for Gold remains bullish, with this current pullback potentially opening the path to fresh all-time highs as fundamentals stimulate appetite for the metal. Looking at the technical picture, a weekly close above $1900 could signal further upside in the medium term.

For those who like to look at Gold on the shorter timeframe, keep a close eye on how prices react around the $1900 psychological level on the H4 charts. Weakness below this level could trigger a decline towards $1870.

Add a comment