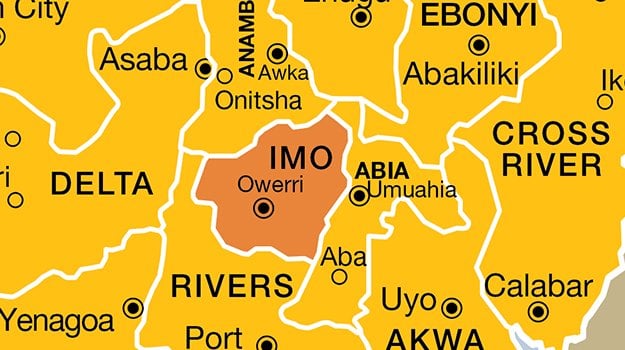

Nyesom Wike, governor of Rivers state, says the federal government should encourage states to harness their resources and generate revenues, including value-added tax (VAT) collection, for development purposes.

This is contained in a statement signed by Kelvin Ebiri, special assistant on media to Wike, on Monday.

The statement follows the current legal tussle over VAT collection between states and the Federal Inland Revenue Service (FIRS).

According to him, states have the legal right to collect VAT, but it is not considered on the merit of the law by some public commentators, including state executives.

Advertisement

He said these public commentators are politicising the issue and looking at it from ethnicity and religion, adding that FIRS collecting VAT was illegal and could be likened to robbing the states.

“You don’t even need to be a lawyer to know that VAT is not in item 58 and 59 of the second schedule of the 1999 Constitution as amended. Everybody knows that. It is not even in the concurrent list,” Wike said.

“Therefore, it falls under the residual list. It is not arguable. That yesterday nothing happened does not mean that today nothing will happen, or tomorrow something will not happen.

Advertisement

“Nigeria should encourage states to be strong enough to have resources to develop their states. We are in a federal system where we are practising the unitary system. Everybody at the end of the month will run to Abuja to share money. Nobody comes back to the state to think, how do I develop my state.

“The issue of VAT did not start from Rivers State alone. It started in Lagos State when Lagos State challenged it in the Supreme Court. Unfortunately, the Supreme Court said you (Lagos) shouldn’t have sued the Federal Government. All you would have done was to sue the agency.

“Some people say, be your brother’s keeper. I have no problem being my brother’s keeper but why not come out and say, let us tell ourselves the simple truth. As it is being provided in the law, who is the person responsible to collect the VAT.

“When you agree that it is the state, then we can sit down to look at the different problems of states. And not to say be your brother’s keeper while you’re doing an illegal thing, in disobeying what the law says you should not do.

Advertisement

Add a comment