“Boldness is not second to everyone, it is intentionality” — Janna Cachola.

History is being made in Rivers State. There is a bold move by the State Government at challenging the retrogressive status quo of the federation. Nigeria’s political structure is not only lopsidedly skewed against the states but has become a clog on the nation’s wheel of progress. Like local government areas, the states are mere appendages of the behemoth center—yet we call this country “Federal Republic of Nigeria”. It is feeding bottle federalism!

The rattling question is: what is federal about a country structured along unitary system by respective military dictatorships. In the last few years, there has been vehement agitations for a restructured Nigeria that will encompass true federalism where states will have the needed autonomy and resources to determine and unleash their socio-political cum economic destinies.

Failure to make any meaningful progress in the direction of restructuring, in the last few years, has birthed agitations for self-determination, especially in southern Nigeria. Restructuring advocates are opposed to separatist campaigners calling for total balkanization of the country. While true federalists believe that Nigeria can still be salvaged via restructuring, self-determination proponents have been pummeling them for not walking their talk.

Advertisement

Rivers State Government has changed the game. Age-longed problems cannot be solved by persistently and indefinitely talking about them without action. There comes a time in history when courageous and well-calculated actions are left to do the talking because all talk and no action makes someone a rabble-rouser reveling in ramblings. Rivers State decided to confront the hydra-headed monster of unitary structure that made states subservient to the center.

The bone of the contention is Value Added Tax (VAT).

Recently, Rivers State Government went to court to challenge Federal Government’s collection of VAT via Federal Inland Revenue Service (FIRS). It argued that FIRS did not have the constitutional right to collect VAT and Personal Income Tax (PIT) on behalf of local governments, states and federal government. It advocated that states should be allowed to collect VAT—and not Federal Government.

Advertisement

On August 9, Justice Stephen Pam of Federal High Court, Rivers State, ordered the tax agency of the FG, the FIRS and the Attorney General of the Federation, from collecting VAT and Personal Income Tax (PIT) from residents of Rivers State. Federal Government via FIRS fumed and vowed to appeal the judgement.

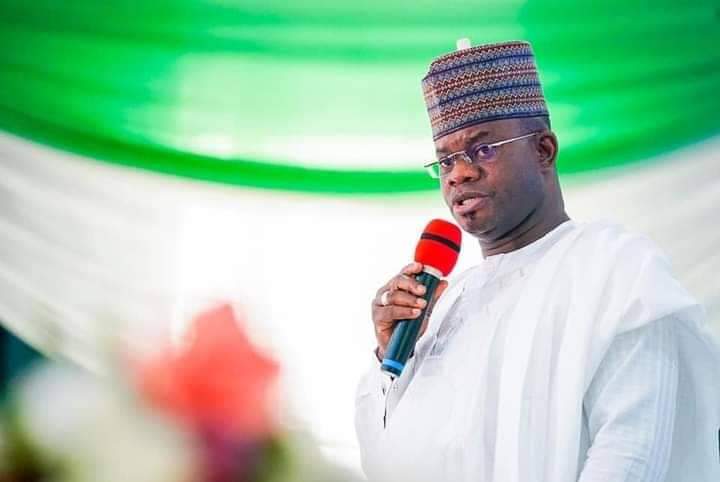

Rivers State Government did not stop there, it ensured that the State Assembly legislated on it through a bill, which was swiftly signed into law on August 19, 2021, as Value Added Tax Law No. 4 of 2024 by the man behind the wheels—Governor Nyesom Wike. I doff my cap for this courageous move of Rivers State Government.

There are insinuations in the media that FIRS is lobbying National Assembly to put VAT in the exclusive list, in order to legitimacy its illegality—to continue the exploitation, and but this move is dead on arrival. I am sure that even all other states will sleep and allow the agency to ambush the states using National Assembly, Rivers State Government under the leadership of Governor Wike will not allow this to happen.

Governor Wike has demystified the bogus term called restructuring cum true federalism. It is not rocket science. He has proved that easiest way to handle mountainous challenge is by compartmentalization of it. My own definition of restructuring of which Governor Wike has accentuated, is using legitimate avenues to get back your resources and power that were illegally taken away using military regimes.

Advertisement

Back to issue at stake—VAT.

Value Added Tax (VAT) was introduced in 1993. The sharing formula; states—50%, LGAs—35% and FG—15%. FIRS gets 4% from FG’s share as operational cost. But the subject of controversy had been whose duty it was to collect VAT—states or FG via FIRS? but the judgement of Federal High Court has lent credence to narratives of restructuring advocates; though FIRS said it has appealed the historic judgment. Let wait and see how it goes. But why is it running to National Assembly if it has water-tight case?

VAT falls under consumption tax, which is within the state government power to collect and remit 15% to the Federal Government. Majority of the VAT are generated from the states, which gave them lion share of 85% in the sharing formula. Why then should FIRS, on behalf of Federal Government, collect VAT and distribute to the state? Did states complain that they lack capacity to collect VAT?

What is the work of states Internal Revenue agencies responsible for Internally Generated Revenues (IGR)? Why will a minority stakeholder in a company be the one collecting revenues, especially when the revenues are being generated from the states—majority stakeholders? Sadly, this illegality cum impunity had gone on unchallenged for decades. As a restructuring advocate, I am happy Rivers State Government has taken the bull by the horn to correct this obnoxious practice of “monkey dey work bamboo dey chop”.

Advertisement

FIRS collection of VAT from states and distributing same via the Federation Accounts Allocation Committee (FAAC), is tantamount to robbing Peter to pay Paul. Majority of the VAT remitted to FAAC monthly comes from just few economically viable states with high volume of VAT generation like Lagos, Rivers, Ogun, Delta, Enugu, Akwa Ibom, etcetera, yet other states get rewarded for indolence and crass unproductivity—the reason Nigeria is economically backward—and poverty capital of the world.

FAAC shared a total of N733 billion as June, 2021 revenue, out of the sum, VAT revenue got N143.6 billion—huge chunk of the VAT came in from alcohol consumption. Look at the injustice and irony here, majority of Sharia-compliant states that routinely destroy alcoholic beverages in their states, did not only partake in revenues from VAT but got lion share of it—going by the hegemonic template of using number of states and local government councils to share revenues.

Advertisement

Why will someone drink beer in Lagos and another person in Kano State that detest alcohol as a result of religious belief gets more share in the distribution of VAT emanating from the produce? This is wickedness taken too far. I strongly stand with Governor Nyesom Wike and Rivers State Government on this courageous step to end this official theft.

Other state governments with huge volume of VAT generation should throw their weight behind Rivers State and see this to a logical conclusion. This is the real battle for a restructured Nigeria. The die is cast. Governor Wike has shown leadership where it mattered mostly and should be railed round. There is a weighty allegation that FIRS illegally withholds some VAT it collects on behalf of the states—it remits only a fraction of what truly comes into it coffers.

Advertisement

States do not control FIRS; its operations and recruitment process, thereby cannot efficiently monitor its modus operandi yet FIRS generates most of its revenues from the states. Ideally, FIRS should not collect VAT outside Abuja—FCT; where FG has substantial control of its Internally Generated Revenues. It VAT collection influence should be limited to FCT alone.

While signing the historic Value Added Tax bill into law, Governor Wike could not hide his ill feelings towards impunity of Federal Government using FIRS to strip states of their VAT revenues, of which made state governors to always go cap-in-hand begging for financial support from the center. He was quoted as saying:

Advertisement

“In this (Rivers) state, we awarded contract to companies and within the last month we paid over N30billion to the contractors and 7.5% will now be deducted from that and to be given to FIRS.

“Now, look at 7.5% of N30billion of contracts we awarded to companies in Rivers State, you will be talking about almost N3billion only from that source. Now, at the end of the month, Rivers State government has never received more than N2billion from VAT. So, I have contributed more through the award of contracts and you are giving me less. What’s the justification for it.”

With this calculated move that has quaked the foundation of the FIRS and rattled Federal Government, Governor Wike has become the Moses of our time leading true federalists to the promise land of a restructured Nigeria. We are morally bound to give him all the support.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment