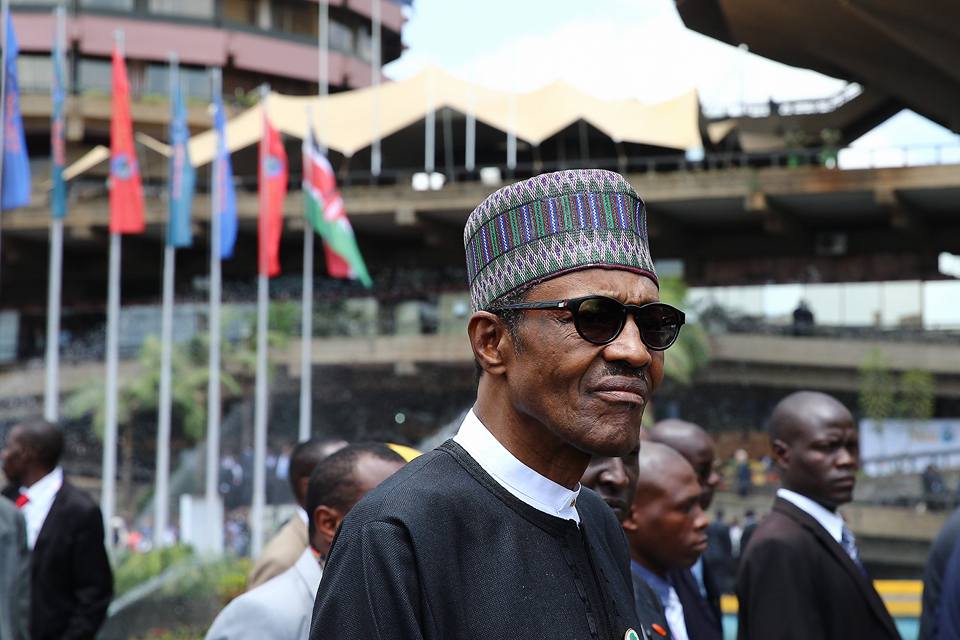

Last month, The Nigerian Times reported that President Buhari was perfecting plans to sell off Nigeria’s stake in NLNG to some businessmen from the Middle East. The paper reported that this deal was being brokered by an influential northern governor.

To the best of my knowledge, no one has denied this report from this newspaper yet.

But the NLNG is an act of parliament. The president needs legislative approval to sell off Nigeria’s 49 percent stake in this organization – if he’s planning to sell as reported. This could be time consuming. Should he be interested in selling off these assets, and of course in good time, he needs emergency powers. Such powers will allow him ‘’abridge the process of sale or lease of government assets to generate revenues’’. (There are reports that the president intends to seek these emergency powers soon).

The president has made comments to suggest he wants to sell off some strategic assets. During his campaign, the president was quoted as saying, “Our manifesto says we are going to break up the NNPC………but the ultimate answer may well be to divest the whole thing. It is an idea that will be seriously looked at.”

Advertisement

In fact, Mr. Emefiele, the CBN governor, argued, in 2015, that Nigeria would easily raise $75 billion from selling off a little over half of its stakes in JV companies. (Nigeria owns about 55 % in most oil and gas joint ventures, while oil majors hold the remaining 45%).

But these assets are the livewire of Nigeria. They are national strategic assets – without them Nigeria might not be able to earn dollars. In fact, in the US and other western countries, there are strict regulations guiding foreign investments that could increase foreign influence, and of course, impact on their national security.

Whoever controls majority stake in these assets will have an overbearing influence on Nigeria and Nigerians. (Presently, Nigerian has majority stakes in JV companies). So, the sale of these assets requires national debates, and should not be done with executive powers, if it was ever considered.

Advertisement

Nigeria has learnt a lot from the sale of national assets. The PHCN assets are good examples. Should the buyers of NLNG, for instance, not have enough money to grow the company – just as we have seen with the new owners of PHCN – the company might become a shadow of itself. That’s after the new buyers might have shred it into pieces. Right now some might see the NLNG as a cash machine – the company is still very profitable.

And most worrisome is the fact that Nigeria has no concrete strategy on how to invest the proceeds from these sales. It is not enough to just mouth infrastructural development. All the proceeds from these assets cannot turn Nigeria into what Dubai is today.

Besides, the sale of these assets requires strong strategic thinking. Should oil prices go up tomorrow, will Nigeria feel shortchanged if the assets were sold with valuations from today’s oil prices and with assumptions that oil prices might never go up again, as some experts believe?

The truth is: Should Buhari follow due process in selling off these assets, he might not be able to sell them before 2019. Interestingly, Dangote argues that Nigeria needs this money to invest its way out of recession, as quickly as possible.

Advertisement

There should be no rush. Why? Early this year, Saudi Arabia announced that it was going to sell off 5 percent of its stake in the state owned energy giant, Aramco. It plans to conclude the sale by 2018. It might even take longer. This is how sales of this nature are carried out – it takes time.

Yes, we need to get out of recession as soon as possible. But there are other short-term measures to take.

One, security votes could be abolished in order to free up capital for more productive ventures. Two, we could sort for low interest loans. Three, Nigeria could fast-track the concessioning of infrastructure such as highways, ports and airports. These could be done while the country works out a unanimous strategy on how to sell off its stakes in these oil assets

With Aliko Dangote and the Senate president putting their weight behind the sale of these assets, the president only needs to make relevant requests to the parliament and support his argument with strong points in town hall meetings across the country.

Advertisement

I agree that the NNPC has been a cesspit, as some NEITI reports have confirmed, but a non-transparent divestment might set this country backwards.

Advertisement

1 comments

I have no doubt in my mind that if the Federal government of Nigeria sells NLNG and other government assets Aliko Dangote suggested to the FG in order to bouy the economy, that the situation would be turned around. Only on the condition that he, Dangote , would be the sole chief executive of such enterprise where takes management decisions with fiat. Wait a minute. Could Nigeria politicians vis-a-vis the elites tell Nigerians why they are afriad to restructure the country back to its precoup era.What will they lose if that is done? All these economic paradigm will fissile out when this is done. Federating states will start working once more as they ought to be working instead of waiting for allocations from the capital. Then and only then will the inherent curruption in the republic disappear, in relative terms atleast.People will begin to work for their living instead of misappropriating monies they did not work for.