Some people say that money can’t buy happiness. However, it is not always true. Of course, you need to work on your thinking, analyze your life, and reflect on your deeds. At the same time, it is not always easy to do without having enough money to cover your basic needs.

It is proven than you can think about your comfort and self-development when you feel safe and know that you have something to eat, where to live, and things to wear. Only then you start spending time on your further needs, entertainment, and education. It means, that money still has a great and strong influence on our lives and only a few people can feel completely happy without money.

At the same time, let’s imagine a person who has several debts and no opportunity to close them. The most possible reason for it is that the person doesn’t know how to earn money and moreover, doesn’t know what to do with it. It this situation, if he or she will receive a sum big enough to cover all debts and also help to improve the financial situation, this will most likely not help. If you don’t know what to do with the money, how to spend it, and where to invest, you wouldn’t learn it in a minute. This knowledge doesn’t come with a big sum.

It means, that you should first change your thinking, your relationship with money, and expand your knowledge of finance. If you will know how to earn, you will see new opportunities and ways where to find the money, regardless of your place of residence, be it Nigeria or South Africa.

One of the great options is Forex trading. It allows people from all over the world to apply their knowledge and invest in stocks or earn on market fluctuations. You can find out more on FXTM Nigeria and create a personal plan on earning money. The Forextime blog is a huge source of useful information for beginners as well as for more experienced traders.

Change Your Thinking

Let’s analyze several common situations that can happen when you need to spend some money.

1. Make sure you need it

Emotional, unplanned purchases make you grieve over the money spent. Therefore, it is better to avoid them: come to the store with a shopping list, ignore inappropriate offers. Even if you asked a consultant a couple of dozen questions, this does not oblige you to buy something.

Better yet, take a couple of days to think. It helps to “sleep” with the thought of buying something for two nights: then it becomes finally clear whether you really need this thing or this is another momentary desire.

2. Try before you buy

Often, reality does not match expectations, so it is better to test an expensive product in advance. You can rent everything: a car, construction tools, a scooter. Having tried in advance, you will know all the characteristics of the product and will stop regretting the purchase.

3. Buy experiences, not products

Before buying, ask yourself what value this item will have. An expensive car gives comfort, and a dishwasher gives you free time. Remember what you bought for, not how much you spent.

4. Stop looking for other options

Perhaps the purchased vacuum cleaner will be sold at a discount in a month. There are likely to be cheap alternatives that you may not have noticed before. But the purchase has already been made, the item is fulfilling its function, so there is no need to look through the offers of stores and reproach yourself – this is a waste of time and nerves.

5. Accept your desires

Feelings of guilt can be muted by learning to define your desires before buying, not after. If you bought something and are sure of the quality, move the check away, immediately tear off the price tag. This will teach you to take responsibility for yourself – it will be more difficult to return the item to the store without a receipt. Over time, you will stop buying things that make you feel guilty.

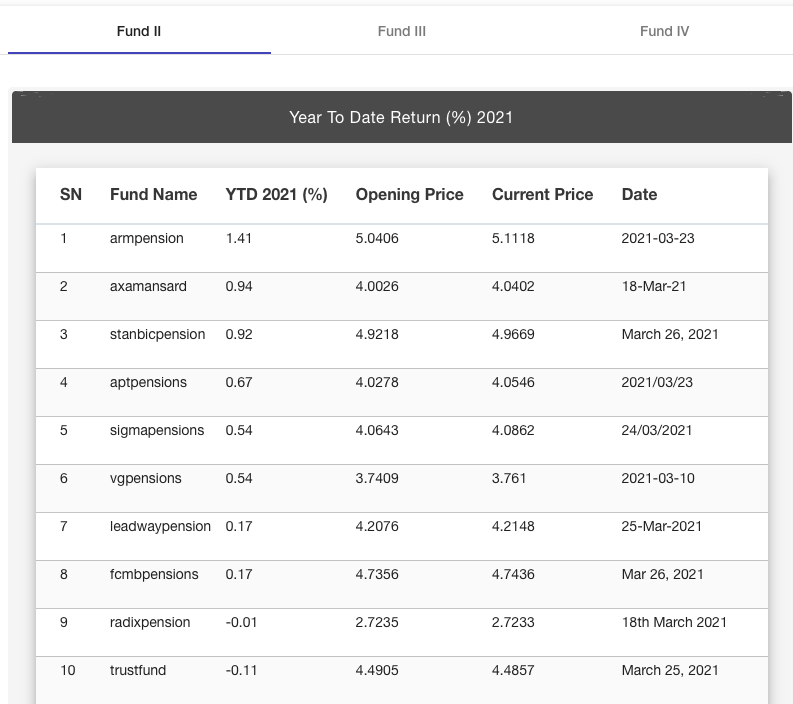

Investments

Investing in stocks is a great opportunity to earn without doing anything. However, you should first have a sum enough to start and develop a strategy. Here are some tips because investing in the stock market is always a risk. But there are several ways to minimize it:

- Determine the purpose of the investment, that is, understand how much money and by what time frame you want to receive.

- Create a diversified portfolio: if some securities fall in price, others will help the investor stay in the black.

- Create an airbag. If an investor suddenly loses their main source of income, it is better to have a stash on the map than to urgently sell shares.

- Invest regularly.

These tips will help you change your life if you also invest your time and resources in learning.

Add a comment