‘Tokunbo Martins, director of the Central Bank of Nigeria (CBN) banking supervision department, has announced the reinstatement of all the banks that were banned from the foreign exchange market.

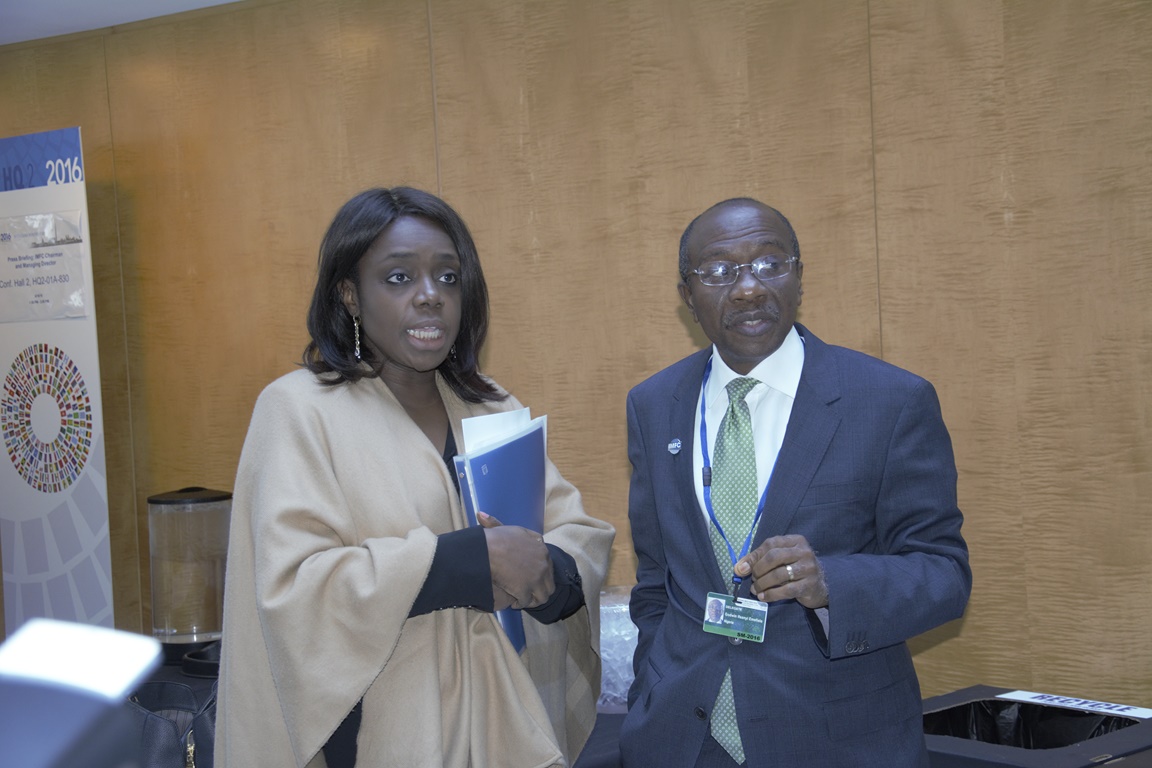

Speaking on Wednesday at a media briefing in Abuja, Martins said the decision was reached after a series of meetings with the body of bank chief executive officers and the Chartered Institute of Bankers of Nigeria.

“Well, we have had engagements with the body of CEOs and they have been interacting amongst themselves and I am happy to tell you today that the banks that were hitherto banned have been released from the ban,” she said.

“And the reason is because all of the banks, after discussions and engagements under the auspices of the body of CEOs and the CIBN, have all submitted credible repayment plans which we, the CBN, found acceptable.

Advertisement

“So as a result of that, all those banks have been reinstated in the foreign exchange market.”

Segun Ajibola, CIBN president, said the institute was very much interested in what was happening among all the industry players.

He added that under the aegis of the institute, the body of bank CEOs was now a formidable platform to examine issues that were pertinent to the industry and the economy, to ensure that stakeholders’ interest was protected.

Advertisement

“We will protect the interests of all our stakeholders and especially the bigger picture, which is Nigeria and its economy as a whole,” Ajibola said.

“So it is a happy development and I believe this will further help to strengthen our system and our economy.”

Herbert Wigwe, managing director of Access Bank, said that the body of bank CEOs under the under the auspices of the CIBN, aims to get banks to work together.

Advertisement