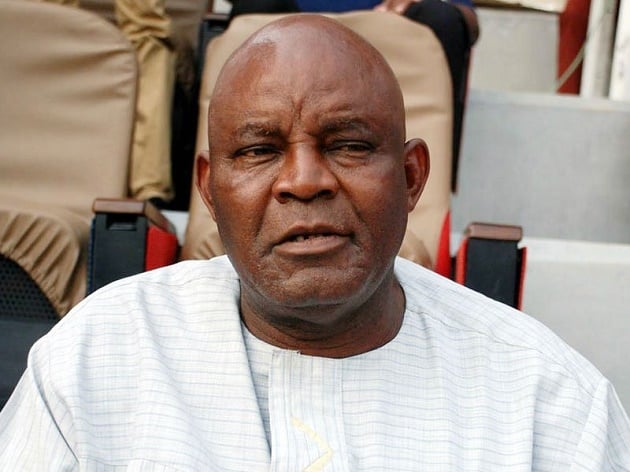

Zacch Adedeji

BY SIKIRU AKINOLA

While many did not see the appointment of Zacch Adedeji coming, it’s doubtful if anyone ever had concerns about his capacity when the steering wheel of Nigeria’s all-important revenue collection agency, the Federal Inland Revenue Service (FIRS), was entrusted to his care.

This is because, before then, a few months into the Bola Tinubu administration, he had held sway as special adviser on revenue to Mr. President, having been appointed straight from the National Sugar Development Council (NSDC), where he’d made his mark, and left indelible prints in the annals of that council.

A clear example of opportunity meeting preparedness, Zacch, as he is fondly called, is one who never wants to fail in any assignment entrusted to him. Thus, he continues to leverage the contacts and experiences he’s garnered in the nearly three decades of involvement in public sector financing, to continue excelling in a path he consciously trudges as the man of excellence that he truly is.

Advertisement

With that small diary that never leaves his hand and a voracious reading habit the finest of eggheads are associated with, he is always in tune with current realities and always ready to listen. Anybody who comes across him will attest to the fact that he is a believer in team play. As a heads-up, never send anything you haven’t read and thoroughly reviewed; he would devour it, analyse it and make more meaning out of it, and you who sent it would wonder if it was the same thing you sent him. He’s such a man of great ideas.

One would think a spirit has been leading Zacch right from secondary school when the idea to study accountancy first struck his mind, as he’s been a star boy right from the moment of that decision.

At the Federal Polytechnic, Ede, where he was the institution’s scholar, he earned the Gani Fawehinmi scholarship. At the prestigious Obafemi Awolowo University, Ile-Ife, he proved his mettle, graduating with a first class in accounting. He would later go on to receive master’s and postgraduate degrees from the same department and institution. As providence will have it, he was awarded his doctorate a few weeks after his appointment as FIRS’ helmsman.

Advertisement

Despite all his attainments, one wonders where he derives his humble mindset. While it is not a matter of stooping to conquer, Zacch derives pleasure from carrying everyone along, with the end goal of giving everyone a sense of belonging in the project.

Perhaps to a fault, he is accessible to everyone that matters at the Service. In terms of native intelligence, he is deep. Everywhere is Zacch’s office, a habit that has endeared him to the top management staff of the Service. Only recently, he spoke about the need to upgrade all top management officers’ offices to be conducive for meetings.

Instead of them coming to his office, he goes to any office as and when necessary to conduct business. To Zacch, everyone matters in the FIRS system. That attitude alone energizes members of staff, leading them to optimum performance.

From carrying out major reviews within the Service to introducing major worker-friendly policies, Zacch is committed to raising the nation’s tax collection, but not at the expense of killing businesses.

Advertisement

Anyone who has listened to Zacch speak will confirm his regular saying that President Bola Tinubu’s number one vision is to banish poverty; a reason he’s entrusted the critical agency to Adedeji, and more importantly, why FIRS’ plan under the Iwo-Ate born first-class graduate of accounting has been tax prosperity and not poverty.

This idea, Zacch opines, is to tax returns, not investments, akin to taxing fruits and not the seed. The logic is that FIRS’ approach to tax administration in Nigeria is one of shared prosperity because its vision as a tax administrator is to access tax fairly, collect equitably, and keep it responsibly.

With an audacious target of 19.4 trillion naira this year, which is not far off from the nearly 13 trillion generated last year, Zacch and his team at the FIRS believe it is doable, with commitment, integrity and purpose.

In order to make things work seamlessly and also to improve efficiency so as to alleviate the compliance burden on taxpayers and collectors, FIRS has had to migrate from the annual filing of Transfer Pricing Returns, and Country-by-Country Reporting (CbCR) notifications from e-TPPlat to the TaxPro-Max Platform, using their regular login credentials.

This, it must be noted, wasn’t without a human face, as the FIRS gave existing and prospective taxpayers up to 30th June 2024 to fulfil all pending filing obligations.

Apart from this, FIRS waived the administrative penalties previously imposed or to be imposed by the Service in accordance with the Income Tax (Transfer Pricing) Regulations 2018 and the Income Tax (Country-by-Country) Regulations 2018.

Advertisement

Believing that tax collection will help the present administration in achieving the majority of its electoral promises and put Nigeria on a firmer footing, FIRS, under Zacch, places emphasis on taxpayers as those are the only customers it has.

At the recently held Commonwealth Association of Tax Administrators, (CATA) management meeting held at Marlborough House, Pall Mall, London, which he is fortunate to lead as president, Zacch did not let it slide without calling on members of the global body for increased capacity building. This, according to Nigeria’s number one tax man, is to enhance tax administration processes among them, as well as build institutional capacity among member bodies.

Advertisement

Marketing Nigeria further after the CATA event, Zacch, when asked by Channels TV about the country’s tax landscape and plans, said: “If you look at general landscape and you see the antecedent or the plan, what Mr. President has done is to first of all reset economic fundamentals, because if you are to tax the prosperity, there must be a good economic environment. That is why we removed subsidy.

Not only that, the Central Bank also unified the rate to make sure that we have equitable access to a good market economy. Mr. President also set up a Presidential committee on tax reform and fiscal policy because one of the major problems we have is the multiplicity of taxes and we’ve done our assessment that what gives us roughly more than 85% of our taxes is not more than nine taxes. So, why do we have these 46 taxes? So Mr. President set that up and when you look at all those things, it’s just to put fundamentals in place to make sure that the tax administration system actually serves the purpose it’s supposed to serve which is one, the equitable distribution of national wealth, and also to be able to mobilize domestic revenue for economic development.”

Advertisement

Not done, Zacch revealed that the Tinubu administration’s plan for tax, when properly looked into, is going into fundamentals so that the nation can have a sustainable way of domestic revenue mobilisation.

Assuring that the country is better going by everything the administration has done in close to a year in office, he noted that President Tinubu’s idea of not increasing taxes but reducing the number we have to a single digit has done wonders.

Advertisement

“If you look at the commencement of consumer credit, which is what will return the purchasing power to people. The plan we have today is that we are focusing on civil servants because of their fixed income and certainty of income. In the next 12 months, it will cover the whole country, and that is the goal to cover the entire manufacturing base because then we would know that people have purchasing capacity.

So, for us, tax is just a consequence of our actions, and that is where you see me as the chairman of the Federal Internal Revenue Service. I work more on economic fundamentals,” Zacch had added in the interview.

Having been found useful by the current administration, Zacch rarely has a private life anymore. From hopping from one assignment to the other, Zacch, it appears, has devoted his entirety to ensuring the success of the Tinubu administration from the tax collection angle, confirming the saying that the reward for hard work is indeed more work.

Akinola, technical assistant (media) to the FIRS executive chairman, writes from Abuja.

Add a comment