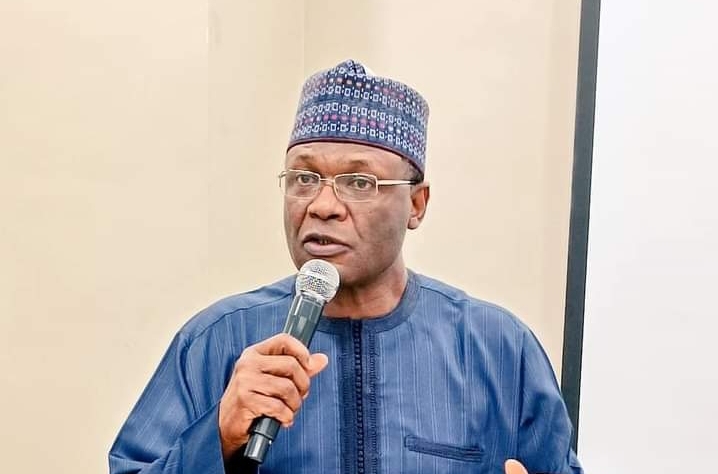

Babagana Zulum, Borno governor, has warned that any bank which refuses to dispense new naira notes would have its land revoked by the state government.

Zulum issued the warning on Friday afternoon in Maiduguri, the Borno capital, after visiting branches of banks to assess problems being faced by residents in trying to access new naira notes.

“Any bank in Borno state that is not willing to ensure their ATMs are fully dispensing new naira notes to ease the suffering of our people, we will withdraw their land title immediately,” Zulum said.

“We will only spare banks with genuine constraints that are verifiable.”

Advertisement

Zulum said he was unhappy when he saw hundreds of people queuing at a bank’s branch, with only one out of 10 automated teller machines (ATMs) dispensing cash.

“As you can see here, only less privileged people are queued up. I didn’t see rich people here,” he said.

“Many people are said to have been here since 3:00 am, some could not even eat anything.

Advertisement

“The new naira note and even the old ones are not available and that is adversely affecting commercial activities in the state and people are suffering.”

Speaking further, Zulum said the state government just released salaries of about N5 billion but the banks were not paying customers.

“We don’t have any problem with the CBN policy or the withdrawal limit, they said individuals can only withdraw N20,000, but why can’t everyone have access to that N20,000?” he asked.

“Yesterday I was in Gubio with a population of over 70,000 people but it was impossible to source N100,000 in the entire local government, neither of the new notes nor the old notes.”

Advertisement

The governor urged the Central Bank of Nigeria (CBN) to ensure the availability of new notes at commercial banks for people to access their money.

“Right now in Borno state, I have visited more than ten ATMs and there’s no cash,” he said.

Last week, Zulum had directed the state’s ministry of finance to hastily establish branches of Borno’s existing microfinance bank across all the 27 LGAs.

Advertisement

Add a comment